A fall in GDP that spans across two consecutive quarters (6 months).

(Apologies if irreverent images pops up under the title, it looks perfectly fine on my laptop and glitches out when i upload)

Whenever something goes through a prolonged period of growth, a downfall usually follows. Whenever a country goes through a period of growth, a temporary decline usually ensues, in economics, we call that a Recession. Australia’s last recession ended on the third quarter of 1991. It has been 28 years and 5 months since then, in that span of time, the US has had two recessions, Europe had one. In fact, Australia holds the world record for the longest time without a recession and the longest period of economic growth that is stretching by the day. Yet that could very much give way to a recession soon.

But before we get to that, we must examine the spectacular rise of the Australian economy and more importantly, the driving forces behind it. Economic growth in any country is closely associated with business investment and consumer demand. If economic outlook is favourable, businesses tend to invest more, hire more staff and increase production. Consumers also tend to spend more, hence creating a positive feedback loop.

The Rise of Australia’s Economy Post 1990s Recession

One of the most important factors behind Australia’s growth is its immigration policy. Currently more than a quarter of Australians were born overseas, significantly increasing the population growth. Immigrants also tend to be younger than the median age, hence boosting the workforce. Most of them also bring in money from overseas, injecting more cash into the domestic economy as well as driving up house prices.

Australia has also benefited tremendously from the recent development of Asian countries, most obvious example being China. Trade between the two countries increased tenfold in the 2000s. Increasing exportation especially in natural resources and investments from overseas only fuelled the economy to new highs.

Tourism from overseas also drives Australia’s economy and businesses. In 2019, 9.4 million international visitors landed in Australia, bringing $45.2 billion into the Australian economy. Further, 23.6% of university students in Australia are international students, they pay up to four times as much as their Australian counterpart, bringing in a further $32.4 billion.

How can a Recession Happen in Australia?

A recession in Australia could be initiated by a number of factors. The trade war between the US and China proved to be a nuisance for Australia not just politically, on one hand you have Australia’s arguably most important ally, and on the other you have Australia’s biggest trading partner. Australia has benefited from the China’s rapidly expanding economy, similarly, any slow down would also affect Australia. Weaker growth in the Chinese economy will lead to less demand for Australia’s exports. In 2019, Australia exported US$89.2 billion worth of goods to China, or 32.7% of total exports, by contrast, the rest of the countries in the top 10 account for US$91.9 billion, or 33.8%.

(Image to right from: http://www.worldstopexports.com/australias-top-import-partners/)

The Wuhan coronavirus also present a threat to Australia in more ways than one. Australia has barred flights from mainland China recently, stopping both the returning international students and tourists from China. Exporting goods to China has also been affected by the virus, with many being agriculture goods that can expire if not sold in time. Taking into account the recent bushfires that has already costed north of $100 billion, the two factors combined could prove detrimental to the tourism and retail industries of Australia as less overseas visitors arrive.

Another factor that has been largely overlooked is the potential effects of the positive feedback loop that Australia has enjoyed for the past 28 years. Despite the benefits, the positive feedback loop also promotes economic instability further down the path. Take the 1990s recession in Australia as an example, the prior growth led to businesses such as Qintex to overextend themselves to the point that a collapse is inevitable in the wake of a weakened economy. As some companies fall and others try to cut losses, massive layoffs occur, consumers are left with less money to spend, in turn lessening demand and further damaging business, resulting in less economic activity in the circular flow of income.

What Happens During a Recession?

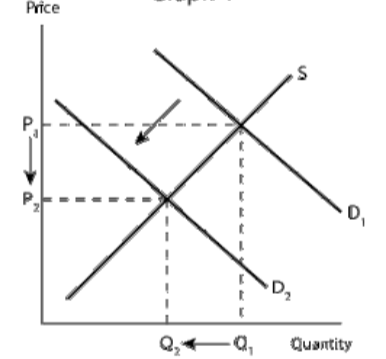

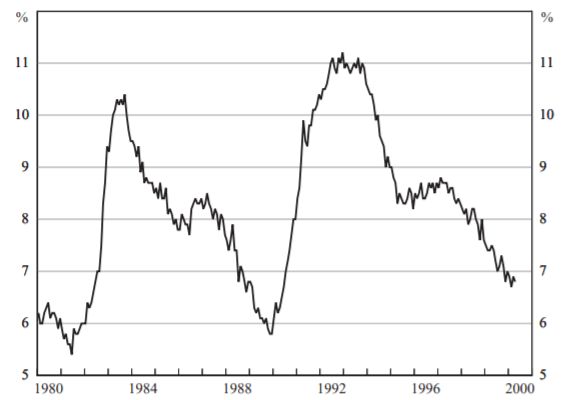

Recession is normally associated with lower wages and higher unemployment rates, leading to the consumers spending less, resulting in lower prices in most sectors. The supply and demand curve to the left demonstrate this perfectly, higher demand leads to higher prices, in this case, a drop in demand causes the businesses to scale back production and investment, in turn lowering the prices to meet the new equilibrium price. During a recession, most companies are unwilling to hire more staff as there is no demand. Although the current unemployment rate of 5.3% will have you believe that the economy is doing well, it is however only a glimpse into the labour force as a whole. Underemployment is still an issue despite the subtle rise in overall employment, currently standing at 8.5%. Expect the two figures to rise significantly if a recession were to happen. But by how much you ask? The current unemployment rate mirrors that of the figures prior to the 1990s recession, during that recession, the figure rose by almost 6% in the span of two years and it took more than a decade to fall under 6% again. Youth unemployment also tend to increase drastically during a recession, as companies are less inclined to take apprenticeships and interns. Research also show that many young people also tend to retreat into education in times of poor economic activity, mostly likely driven by the increasing competition as a result of fewer jobs.

Can a Recession be Avoided?

Well, that is a complicated question. Usually, governments will decrease the interest rate significantly prior or during a recession to boost the economy by encouraging businesses and individuals to loan and invest. However, it’s hard to see any reduction from the current 0.75% to have a meaningful impact on the economy. The near-zero interest rate will prove catastrophic if a recession does arrive, much like the US during the 2008 recession.

However, it is possible for a country to go through a period of zero-growth and not fall low enough for a recession. Take the 2008 recession that Australia narrowly avoided, while back then they did have the option of slaying interest rates, it is important to also look at other steps that the Australian government did to recover and to stimulate the economy. A $10.4 billion stimulus package introduced in late 2008 proved instrumental in lifting the economy, it mainly flowed to pensioners, low-income families, housing construction support and new training places. The stimulus package targeted the perceived weak-links in the economy at the time, the support for low-income families also served to maximise the stimulus effect for the entire economy, as low-income families tend to spend more of any addition income compared to other groups. When 2009 came around, it was obvious that the global downturn was much worse than the Australian government previously thought. A second stimulus package worth $42 billion was announced, this time the package targeted nationwide infrastructure programs to create more jobs and lower unemployment. And although the unemployment rate did rise slightly from 4% to 5.75%. The steps taken by the Federal government and the RBA proved enough to keep Australia out of the global recession of 2008. Whether something similar could work if a recession were to occur in the future remains unseen.

Bibliography:

https://www.investopedia.com/ask/answers/032015/are-economic-recessions-inevitable.asp

https://smallbusiness.chron.com/happens-interest-rate-during-recession-70277.html

https://en.wikipedia.org/wiki/Christopher_Skase

https://en.wikipedia.org/wiki/Early_1990s_recession_in_Australia

https://www.farmonline.com.au/story/6626699/what-impact-is-coronavirus-having-on-our-ag-sector/

https://www.thebalance.com/the-history-of-recessions-in-the-united-states-3306011

Click to access lsay_researchreport60_2512.pdf

https://china.embassy.gov.au/bjng/relations1.html

https://www.abs.gov.au/ausstats/abs@.nsf/Latestproducts/3412.0Main%20Features22017-18

https://oec.world/en/profile/country/aus/

https://www.abs.gov.au/ausstats/abs@.nsf/mf/6202.0

https://www.rba.gov.au/publications/bulletin/2010/mar/1.html

Click to access Underemployment_in_Australia_2019.pdf

Yeah solid article mate

LikeLike