Bushfire outbreaks in South East Australia, the Corona Virus epidemic, consumer spending the weakest in ten years, shrinking business investments and the list goes on. Well hasn’t the start of the decade been just fantastic for us Aussies!

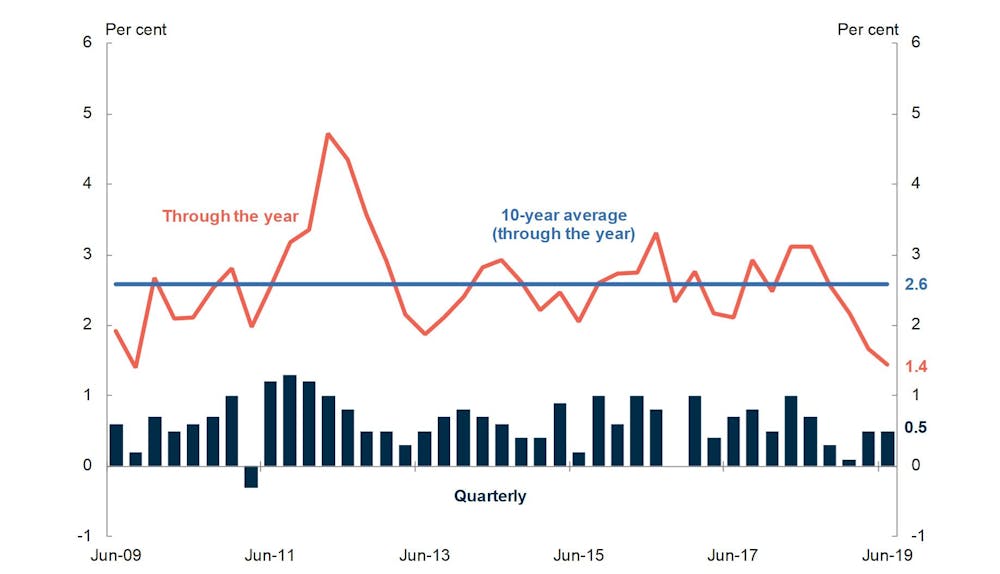

Ever since the 2008 financial crisis, Australia has had one of the weakest economies out of the developed countries, and if it weren’t for Australia’s strong export income growth and surges of government spending the economy would have dropped futher. Although the Treasury expects and believes that the economy can sustain a 2.75% growth, so far the economy has had an economic growth just over half at 1.4%. The economy has not been this low since the recession!

The problem with Australia’s economy is that ever since the start of the 2000s, the economy has mainly been fuelled by the mining boom due to Australia’s vast resources of minerals such as iron ore, nickel, copper and aluminium which converts into export income, and the housing market fuelled by debt. Many economists stress the idea of diversification of Australia’s economy and finding another engine to propel it.

In hopes of stimulating the economy, the RBA had to cut interest rates to 0.75%, a historic low. However, it seems that further cuts on the interest rates have not really had that much of an effect on the growth of the economy as consumers still seem timid to buy and make loans. This is because of the high levels of household debt combined with stagnant wage growth and a dispoportionate increase in the cost of non-discretionary spending. These are some of the reasons why consumer confidence has been at some of its lowest in years, and even if interest rates are being cut down, consumers are more worried about paying down their own debt and meeting the increase costs of living rather than taking on more debt or reduce saving.

This has lead the economy to stagnate, where growth seems to have been very low and consistent, but it is possible for economic growth to plunge even further than it has already.

So what can Australia do to get out of this situation? Well the RBA believes that if the Aussie Dollar were to fall by 5%, it will help boost wages, push inflation into its target band and ultimately deliver a high economic growth sooner than currently forecasted. Whatever may be the case, hopefully our economy can get itself back together.

References

Australia’s economy has certainly been stable for a very long time, without periods of massive growth. It was interesting to gain some insight into why consumers are taking fewer risks (taking loans, and starting businesses) as household debt is straining consumers’ wallets. Very interested in the direction the RBA decides to take, and subsequent impacts on the Australian economy.

LikeLike