Introduction:

Boomers, always causing problems. Modern Australia has 5 million of them, and they are getting old. It turns out that as our beloved Boomers grow older, they are causing us even more problems than they were before. As of 2019, Boomers were costing the economy $10 Billion a year, by 2028, when most are retired, they are estimated to cost $36 Billion a year, more than the government currently spends on medicare for context.

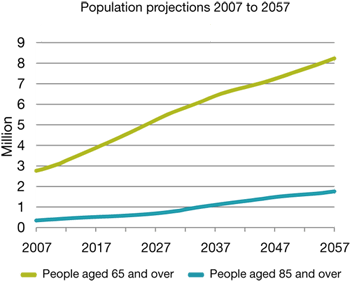

Now contrary to popular belief, this increase in cost is not just due to the exorbitant demands of this particular generation, in fact, it has very little to do with it at all. Due to our medical advancements, there are simply far more people reaching retirement age than before. When the age pension was created for over 65-year-olds, the life expectancy was 55.2, it is now 82.5, and the age at which the pension is received hasn’t moved at all. Now this on its own is an issue, but when we look at the age demographics of our country, specifically the dependency rate, it becomes a crisis.

“The harsh reality is that Social Security wasn’t designed to finance 20 to 30 years of retirement.”

Causes of the Crisis

So what do I mean by the dependency rate? The dependency rate is the ratio between working individuals and those who are retired. In the 70’s it was 8, as in 8 working people for every retiree, now it’s 4. By 2066, when our generation is scheduled to retire, it will be 2. See the issue? Two people, paying $17,146 dollars a year in tax on average (in 2020 dollars, assuming dramatic wage rises do not occur which is perhaps an unfair assumption, but then care cost would rise as well) would have to support a single person between them, in addition to paying for all the other services we expect the government to provide.

The reason that we have this problem is due to a drastic decline in fertility rates. The fertility rate of Australia is 1.74, well below the replacement rate of 2.1, required to sustain a population. As of now, this is offset by migration, but as our cities become more crowded, and populism grows, it is becoming increasingly clear that we can no longer use immigration to prop our economy. To illustrate just how heavily our economy relies on immigration, immigration contributed 1.66% to GDP growth last year, while the economy only grew 2.2%, meaning immigration is the largest factor causing growth by a four-fold margin.

So how can we hope to solve this problem? Well, there are many solutions, each with their various opportunity costs. However, I believe that the following will be the most effective.

The Solution: Industry based retirement age raise

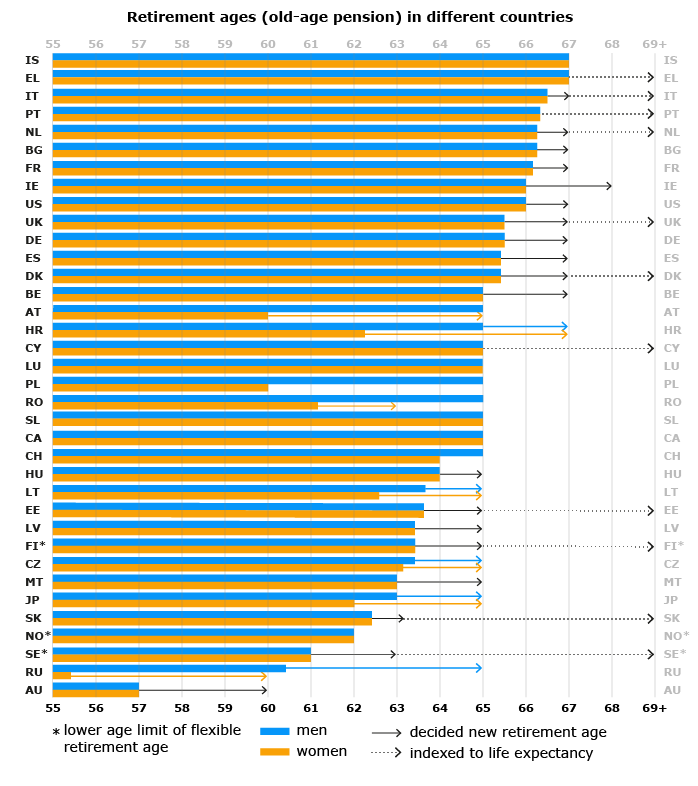

It is well known that simply raising the retirement age, while saving a huge amount of cost, is simply not feasible. A tradesman no longer has the physical ability to work after the age of 65. However, a white-collar worker can work for longer, for example, the president of the USA is 73.

Raising the retirement age to 70 for white-collar workers will be a double whammy. Firstly, fewer pensions have to be paid out, saving Billions. Secondly, white-collar workers will continue paying taxes for another 5 years, allowing the government to collect on average an extra $85k per person. This would still be extremely unpopular, and only a Temporary solution (the retirement age cannot keep being raised forever, and life expectancy is still rising). But it should tide us over long enough for Automation to become significantly advanced to compensate for a smaller labor force

Due to this smaller Labour force, companies should receive massive profit boosts, allowing the government to implement a 40% tax on all market revenue, as is estimated by the US treasury. This should be more than enough to pay pensions for the foreseeable future, in fact, it is estimated that we could easily afford to pay every citizen $1000 dollars a month, also known as a UBI. Considering that the elderly are only estimated to end up making up a third of the population at peak, it certainly shouldn’t be too difficult to afford pensions in this scenario.

Bibliography

https://theconversation.com/solving-the-population-problem-through-policy-110970

https://www.weforum.org/agenda/2016/09/5-ways-to-prepare-for-tomorrows-ageing-population/

Very interesting read on a unique topic and great use of data to back it up

LikeLike

An extremely in depth look at a pressing issue with viable solutions presented as well.

LikeLike