Who’s OPEC?

The Organization of the Petroleum Exporting Countries (OPEC) is a pack thirteen oil-producing powerhouses unifying their petroleum practices to collectively achieve “permanent sovereignty over international oil production.” Some OPEC members include Saudi-Arabia, the UAE, and Iraq.

Russia – the second largest oil exporter in the world – was never included until 2016, via a passive agreement called the OPEC+ deal. Joint Russian-OPEC efforts have demonstrated relatively high and stable oil prices in recent years.

What Does OPEC Want?

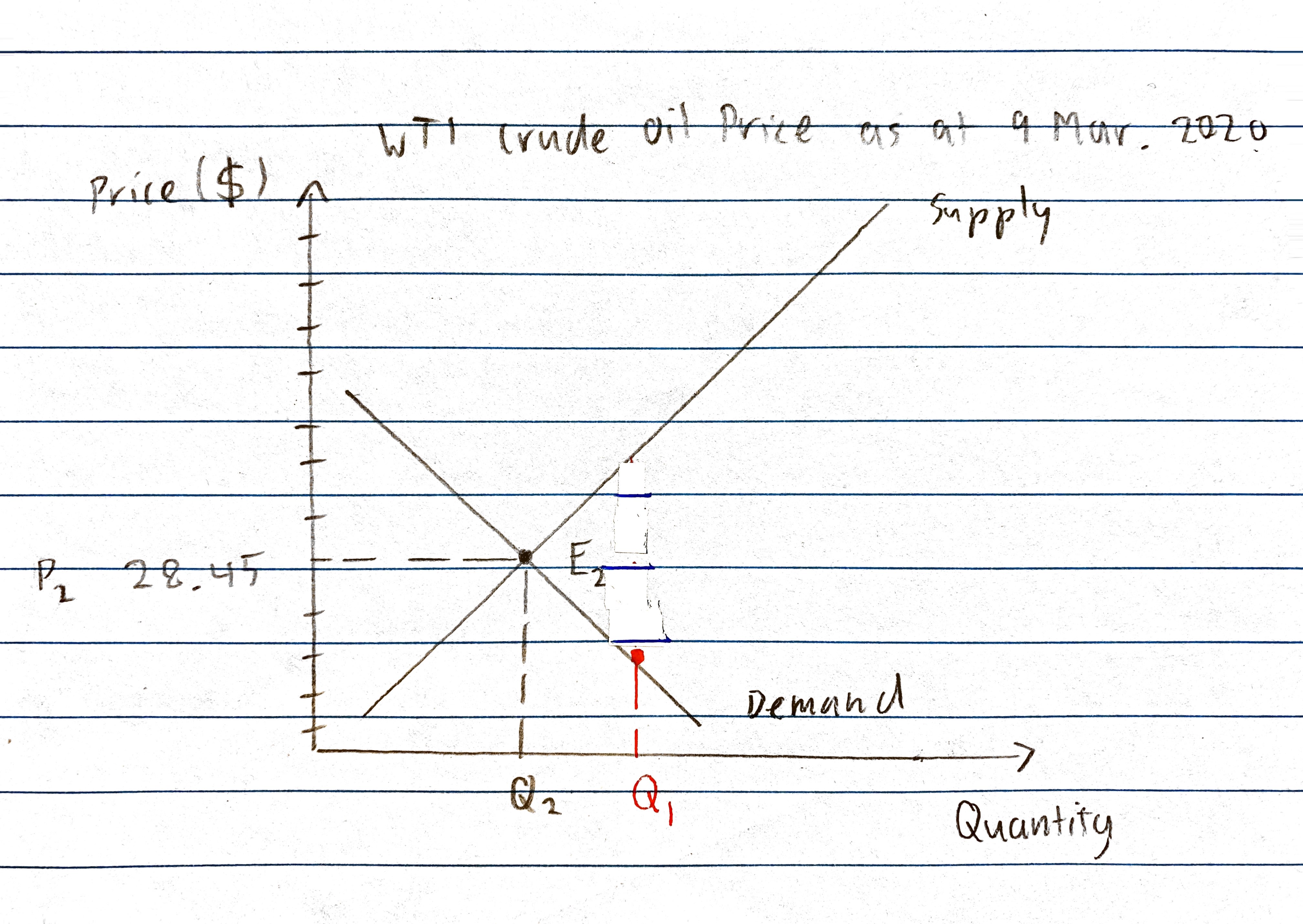

Recently, the global COVID-19 pandemic has decreased the demand for oil substantially. For instance, if there are thousands of people affected with Coronavirus in your town, you are unlikely to drive out to restaurants or parties and instead most likely stay home. Therefore, consumers are not needing as much petrol as they use to. Moreover, crude oil is used to make jet fuel and since there has been a halt in international travel, airline companies do not need as much jet fuel. This situation can be represented on a supply-demand diagram.

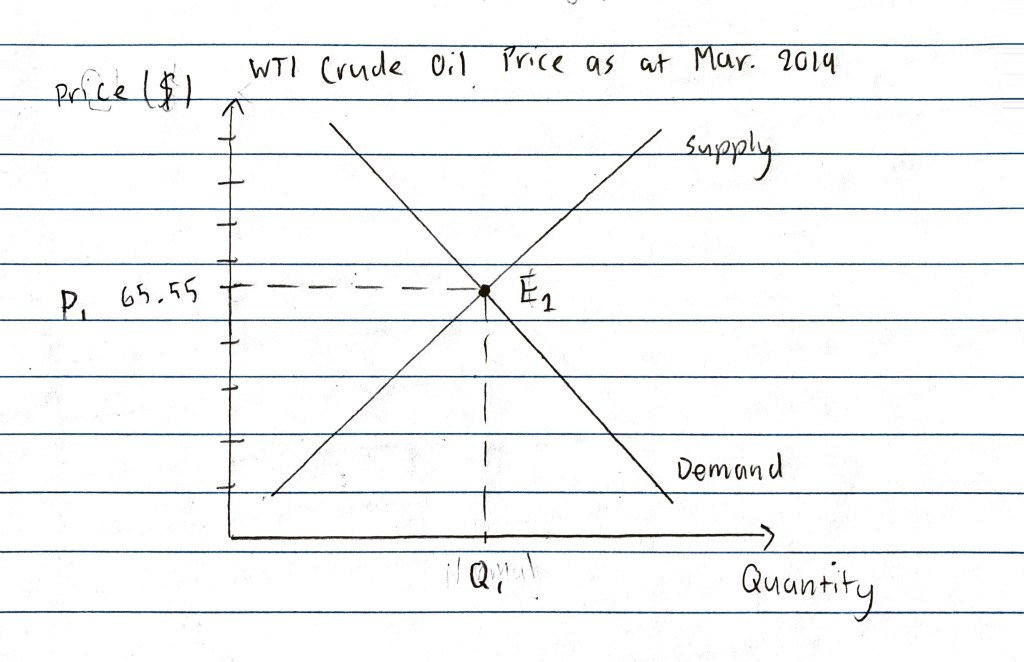

One year ago, there was a relatively high demand for crude oil and the continuing OPEC+ deal skillfully regulated the quantity of crude oil produced. This created an equilibrium at E1 on the left graph where the demand and supply of crude oil intersected. This equilibrium (E1) dictated the price and quantity the nations must produce and sell at to avoid surplus and shortages. Therefore, the price was set at USD$65.55 per barrel as at 9 Mar. 2019, shown on the y-axis.

In the right graph, the demand curve shifts closer to the axis representing the COVID-19 impact on crude oil demand. To compensate for decreased demand, oil producers must decrease the quantity produced, so the price does not drop too much. You can see if OPEC and Russia continue to produce at the same quantity as 2019 (Q1), the price of oil will drop even lower.

Therefore, OPEC desperately wants Russia to decrease production so prices can become regulated again.

But Why is OPEC Increasing Production Then?

In light of COVID-19, OPEC wants to set an example by drastically increasing production to saturate the market and crossing their fingers that Russia will conform to their new interests.

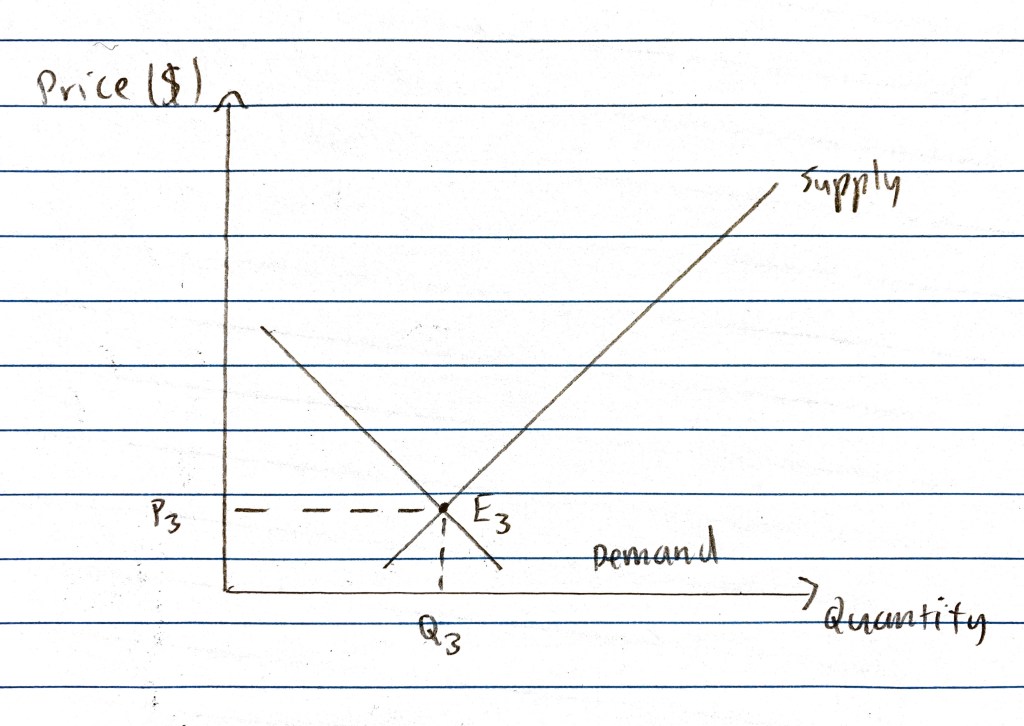

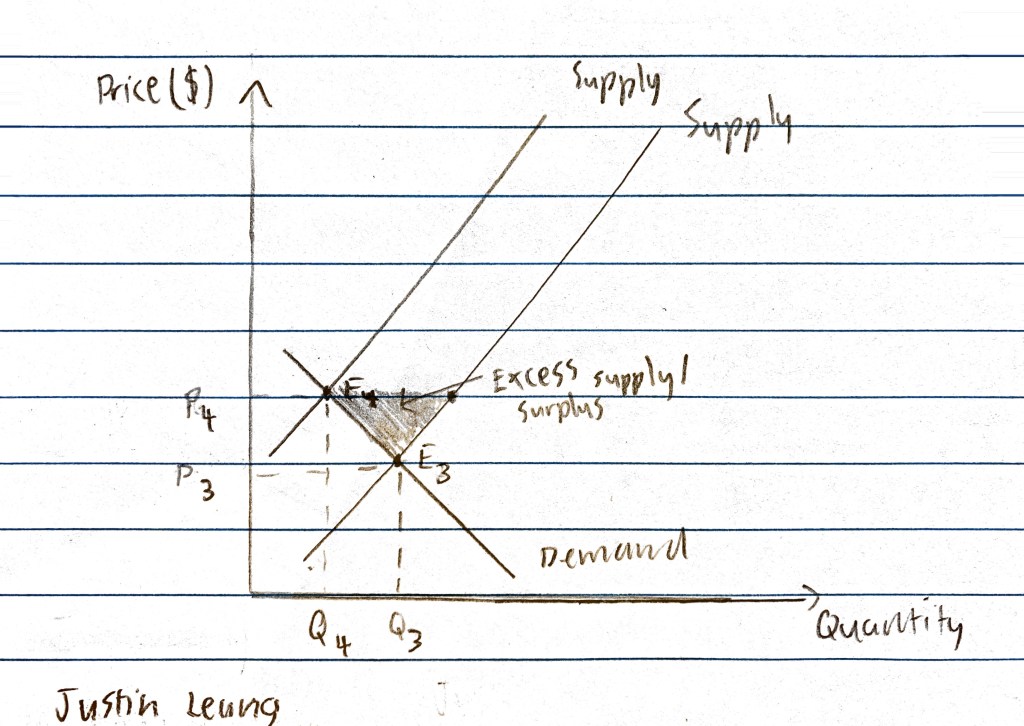

OPEC’s response to the shifted demand curve can be illustrated by this graph. By increasing its supply, OPEC now produces at quantity Q3. A new equilibrium for dictating the price is created at E3. The consequence of this is that the price has lowered drastically, shown by point P3.

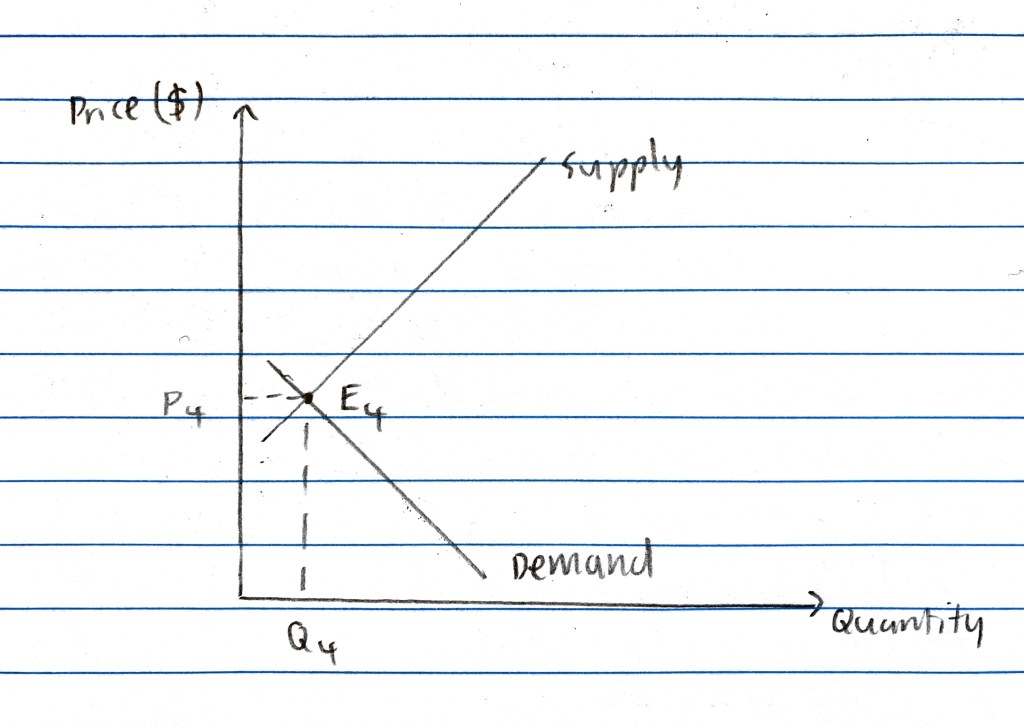

In contrast, Russia’s supply curve has shifted in the negative direction, meaning their quantity produced is at a point less than OPEC at Q4. Therefore, the prices will need to be higher than OPEC’s as the equilibrium (E4) is higher than E3.

Both OPEC and Russia’s quantity and prices are represented on the same set of axes here. Due to OPEC’s increased quantities and lower prices, there is a surplus in crude oil. OPEC has successfully lowered the oil prices and therefore makes them a more attractive exporter to consumers than Russia.

Impact on Stakeholders

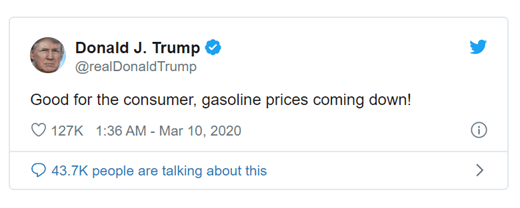

As a result of the OPEC-Russia dispute, petroleum prices are heading towards record lows. Like President Trump says, low petrol prices are good for consumers as they do not have to spend as much of their disposable income on fuel. Treasurer Josh Frydenberg is also in support of the price cuts as he told reporters in Canberra, “I wanted to re-emphasise to the ACCC the importance of holding the oil retailers to account in ensuring that Australians get the benefit from the lower oil prices.”

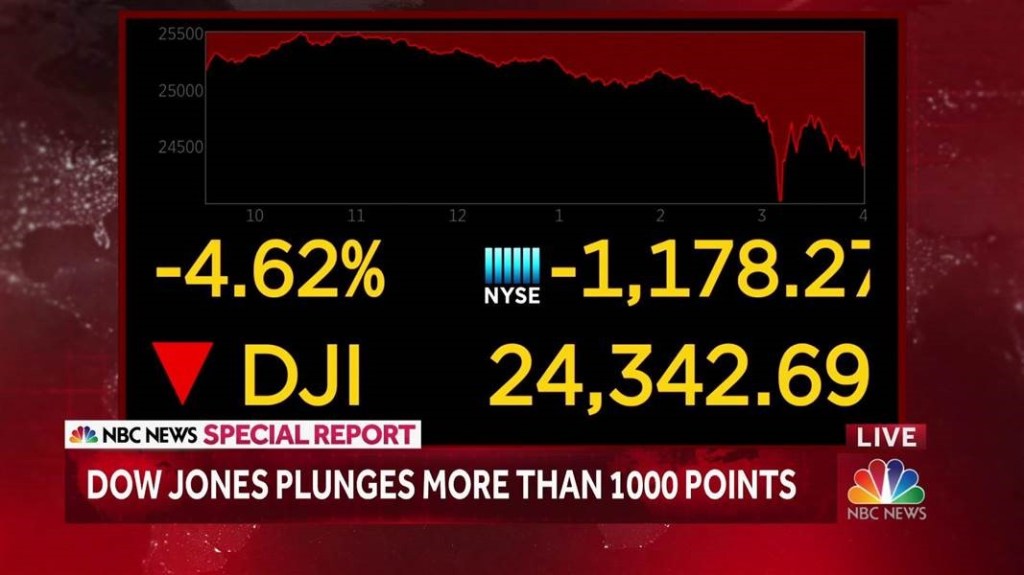

However, the news is not as good as it seems. Numerous global stock indexes saw tremendous losses as a result of the oil price cuts combined with present Coronavirus fears. For instance, the Dow Jones Industrial Average, which consists of stable blue-chip companies, dropped more than one thousand points in a single day. Billions of dollars have been wiped off our share markets, leaving consumers with devalued investments.

Moreover, many of Russia’s oil refineries are located under ice caps. These ice caps need to be melted to gain access to the oil underneath them. If Russia were to increase oil production, they would need to melt more ice caps, emitting more greenhouse gases in doing so. In addition to the pressure by OPEC, there are environmental considerations Russia must face if they were to cut their prices. Russia is in a very difficult situation in terms of weighing up the costs of retaining current oil practices against their carbon footprint.

Referring back to Trump and Frydenberg’s comments, cheap petrol is not useful to us if everyday is 45°C out and everybody is staying inside.

After all…

When Russia and OPEC’s interest aligned, the oil market was much healthier than it is today, as you could buy two barrels of oil today for the price of one in 2019. We are yet to see if Russia agrees to OPEC’s regulations as of 10 Mar. The sooner this “oil standoff” between Russia and OPEC ends, the sooner we might see a recovery in our share markets. Otherwise, we could be witnessing the beginning of our very first bear market run since 2009.

Author: Justin Leung ECO1

References

Nytimes.com. 2020. Saudi-Russian Alliance Is Strained As Coronavirus Saps Demand For Oil. [online] Available at: <https://www.nytimes.com/2020/02/07/business/opec-russia-saudi-arabia.html> [Accessed 9 March 2020].

OilPrice.com. 2020. WTI Crude Oil Price Charts | Oilprice.Com. [online] Available at: <https://oilprice.com/oil-price-charts/45> [Accessed 9 March 2020].

Smith, R., 2020. Why Isn’t Russia A Part Of OPEC? | The Motley Fool. [online] The Motley Fool. Available at: <https://www.fool.com/investing/2017/03/29/why-isnt-russia-a-part-of-opec.aspx> [Accessed 9 March 2020].

Vox. 2020. How Coronavirus Led To A Russia-Saudi Arabia Oil War. [online] Available at: <https://www.vox.com/2020/3/9/21171406/coronavirus-saudi-arabia-russia-oil-war-explained> [Accessed 9 March 2020].

Workman, D., 2020. Crude Oil Exports By Country. [online] World’s Top Exports. Available at: <http://www.worldstopexports.com/worlds-top-oil-exports-country/> [Accessed 9 March 2020].

Kozhanov, N., 2020. Does Moscow’S Withdrawal From OPEC-Plus Deal End Russia-Saudi Honeymoon?. [online] Al-Monitor. Available at: <https://www.al-monitor.com/pulse/originals/2020/03/russia-saudi-arabia-opec-deal-end-honeymoon.html> [Accessed 9 March 2020].

this is some really interesting stuff, I like the connection to the environment

LikeLike

Very interesting Justin Leung! Especially the impact the oil industry has on the economy, as well as the environment.

LikeLike