Here in Australia, healthcare is a two-tiered system, consisting of government-based health care and private health insurance. The government-funded system, Medicare, provides basic universal care for all Australians. While private health insurance provides members with access to private hospitals, shorter wait times, and benefits and treatments not covered by Medicare. It’s a delicate balance, with private health insurance to supplement the public system.

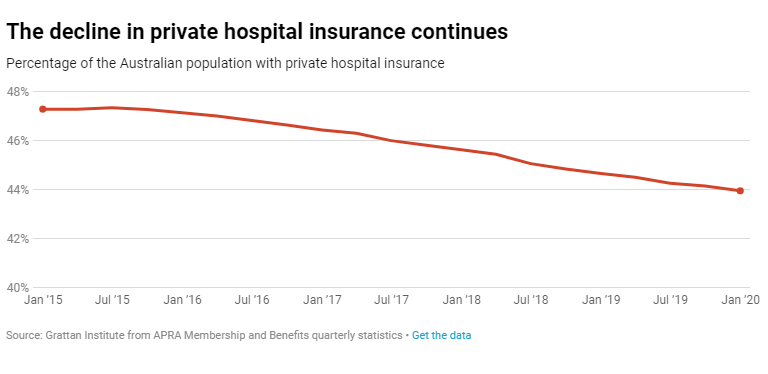

On the surface, it’s an excellent system, with Australia’s healthcare system consistently ranking near the top of the developed world. However, the sustainability of this two-tiered system has been called into question, as there has been an exodus of young Australians from private health insurance. On April 1st, private health insurance premiums are set to rise by 2.91%. Despite being the lowest rise since 2001, it’s unlikely that this will stop the drain of young people from the private health system. So what’s causing this decline and what is the industry and government doing to stop it?

The Death Spiral

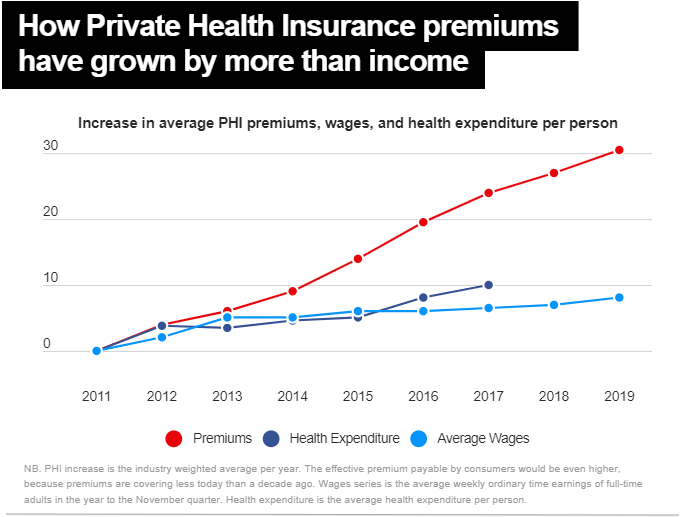

More than 9,000 people left their private health insurance late last year, the largest decline being the 25-29 age group. Young Australians are leaving private health insurance due to the rising premiums. Premiums are the monthly fees a member pays. In 2018, premiums rose by 3.95% while wages rose by only 2%. The cost of premiums are outpacing wages and inflation thus leading to young people deciding that it’s not in the financial interest to hold private health insurance.

As more and more young people leave, the ‘risk pool’ of the insured population worsens and causes the price of insurance to go up for everyone, which leads to more people dropping out. Insurers lose out because fewer people are purchasing private health insurance and those who are still insured lose out because they have to pay higher premiums. This is the private health insurance death spiral, where young people are leaving an unaffordable system while the elderly are desperately trying to stay in.

Levies and Rebates

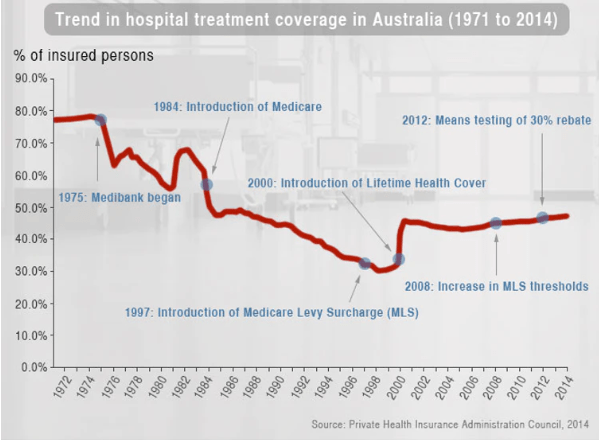

With its considerable spending power, the government have attempted to increase the uptake in private health insurance on multiple occasions through the use of financial incentives.

Negative financial incentives are meant to encourage people to purchase private health insurance through the threat of punitive financial actions. These incentives are the Lifetime Health Cover Loading and the Medicare Levy Surcharge. The LHCL is a 2% loading on premiums for every year after 30 that you don’t have hospital cover. The loading can range from 2% to 70% of one’s premiums. Meanwhile the Medicare Levy Surcharge is designed to encourage high-income earners to take out hospital cover. The surcharge is a rate of 1-1.5% from singles income of $90,000 and family income of $180,000.

The main positive financial incentive for having private health insurance is the Private Health Insurance Rebate. Depending on the circumstances, an individual can save up to 33% of their premiums through the rebate. The government funds the rebate and believes that the policy encourages low to middle-income earners who are put off by the costs, to purchase private health insurance. Insurers can also provide a youth discount of up to 10% for adults aged between 18-29, to encourage them to take up private health insurance.

Despite all these government incentives, the trend has been pointing towards declining participation rates in private health insurance. Meanwhile the youth discount introduced last April has only stymied the decline, with 1,700 young people (25-29) per month leaving during the first six months of 2019 compared to 2,100 people in the three years prior.

Source: Private Health Insurance Administration Council

Source: ARPA

The Future of Private Health Insurance

Insurers have blamed the cost of rising premiums on the high cost of medical devices, stating that prices of medical devices were set at high levels by world standards. This claim was strongly disputed by the medical devices industry, blaming insurers for their mismanagement and greed.

Nevertheless, Australian taxpayers subsidise an unsustainable system that more and more people are leaving everyday to the tune of $6 billion. This death spiral will hurt the elderly and vulnerable the most, as they are the ones who are most desperate to stay in the private system. But an unaffordable private healthcare system will lead to more people pressuring the public system and will lead to worse outcomes for all (ie. longer wait times).

One solution proposed by the Grattan Institute, would decrease premiums for young people and result in a small increase for seniors. This would create better value for young people and encourage them to purchase private insurance as currently, everyone pays the same premiums regardless of age. Personally, I would like to see more funding for Medicare so that it does away with the need for private health insurance or at the very least, provides dental and optical care.

It’s important that we have a good healthcare system, now more than ever with the threat of COVID-19. A healthy poulation is a healthy economy, more productive and innovative. But the private health insurance death spiral is threatening the sustainability of our health system and citizens. Unless there is significant structural change, private health insurance will die a slow death and this will hurt us all.

References

https://thenewdaily.com.au/life/wellbeing/2020/02/18/health-insurances-figures-2020/

https://www.abc.net.au/news/2019-12-04/private-health-insurance-/11762778

https://www.privatehealth.gov.au/health_insurance/what_is_covered/medicare.htm

https://www.vox.com/policy-and-politics/2019/4/15/18311694/australia-health-care-system

https://www.canstar.com.au/health-insurance/private-health-insurance-rebate/

https://www.canstar.com.au/health-insurance/health-insurance-discounts-young-adults/

https://theconversation.com/infographic-a-snapshot-of-private-health-insurance-in-australia-39237

https://www.abc.net.au/news/2016-08-22/costly-health-insurance-blamed-on-fixed-prices/7771568

Very interesting analysis into this often overlooked topic. I wonder how this phonemon will trend in the coming months now that Coronavirus is plaguing much of the nation.

LikeLike

I agree with your opinion, hopefully our PM can find a solution for this.

LikeLike

A very insightful view of the health insurance market. I wonder what would happen to our economy based on this reduction of private health insurance customers.

LikeLike

Very interesting! Our government must do something about this and balance out the costs of health insurance and their premiums with the spending power the average person has. Hopefully soon!

LikeLike