Oil serves as the lifeblood for industry and is undoubtedly, if not, the most valuable commodity in the world, as it used in a myriad of ways- ranging from its use as an energy source to power vehicles, planes, and electricity, to the production of plastics, medicines, and chemicals once it is refined.

A commodity is a basic good that is interchangeable with other goods of the same type.

As a result of this, the oil industry is so puissant that the movements in price are watched by investors and trades extremely closely. And since Oil is in great demand and because it has no real substitute that can fulfill or perform all the functions of oil, the prices of oil are extremely volatile ( due to several reasons which will be explored further). A deficit of oil and gas would have the world coming to a standstill as they provide for over 50% of the world’s energy In other words commodities like Oil and Gas, at this point, are quintessential resources.

A MAJOR PLAYER IN THE MARKET

According to IBISWorld, the total revenues from the oil and gas sector amounted to $3.3 trillion in 2019, and with the global Gross Domestic Product amounting to $86 trillion in 2019, this sector alone accounted for about 3.8% of the global economy.

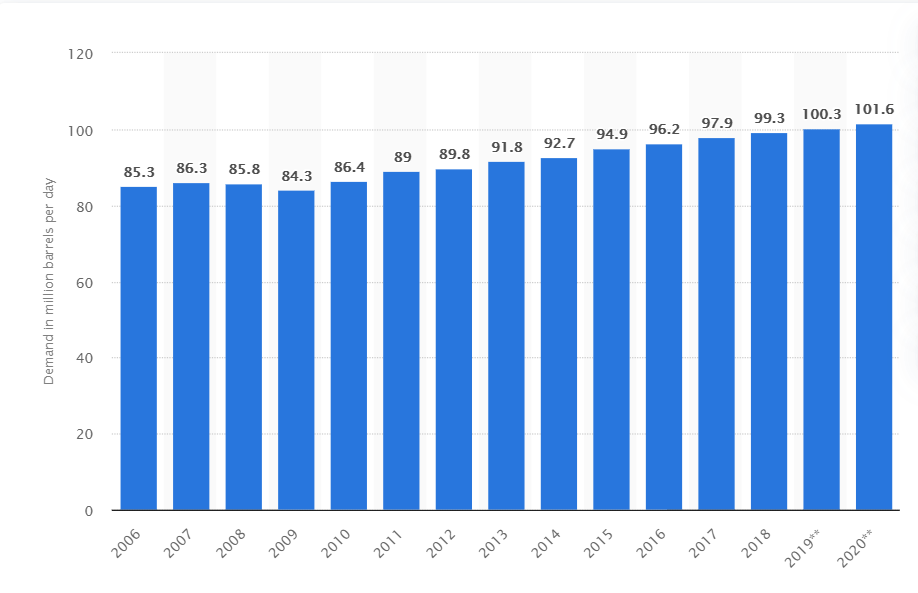

Global demand for oil ( crude oil ) has been on the rise and is expected to continue rising. Figure 1 indicates the growth in the daily demand for crude oil in millions of barrels. Between 2006 and 2020, there has been an increase of over 16.3 million barrels per day, between 2006 and 2020 (a rise from 85.3 million barrels per day to 101.3 million barrels per day). This represents a 19.1% increase within the past 13 years.

Figure 1-Daily demand for crude oil worldwide from 2006 to 2020 (in million barrels)*

GENERAL ATTRIBUTES OF OIL IN THE MARKET

When talking about volatile oil prices in the short run, it is important to consider the economic attributes of oil and the factors that determine how it is priced. When talking from a perspective purely based on price, the demand and supply of oil is different from that of other commodities.

First and foremost, oil has a low-price elasticity of demand and a low-price elasticity of supply to price changes in the short run.

Elasticity of Demand shows how sensitive the quantity demanded is to a change in price.

Therefore, since oil has a low-price elasticity of demand, or is inelastic, the changes in prices have a low impact on consumer habits and generally do not encourage greater or lower consumption. This is because oil is a basic necessity and can’t be substituted efficiently with any other good/commodity ; it serves as the core for many of the products and services received. Therefore, regardless of whether oil prices are high or not, there will only be minor changes in consumer behavior i.e. lower prices do not encourage more consumption and vice versa. In inelastic curves, it takes a big jump in price, to alter demand in the curve

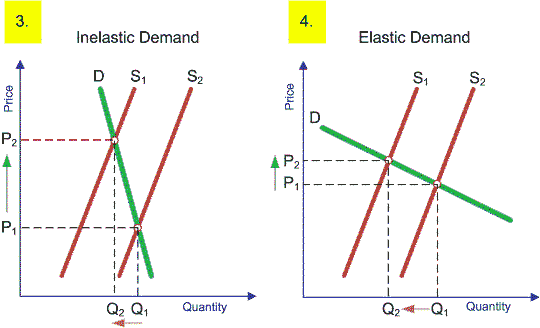

The below figure represents inelastic and elastic demand. The demand slope for inelastic demand is much steeper than that of elastic demand. Therefore, as the slope is steeper, what we can seen that is a shift in the supply slope to the left, results in a significantly greater increase in price, in comparison to that of a elastic demand.

Inelastic demand therefore contributes towards the volatility of oil.

Figure 2- Elastic and Inelastic Demand

Elasticity of Supply measures responsiveness of the quantity supplied of a good or service to a change in the price.

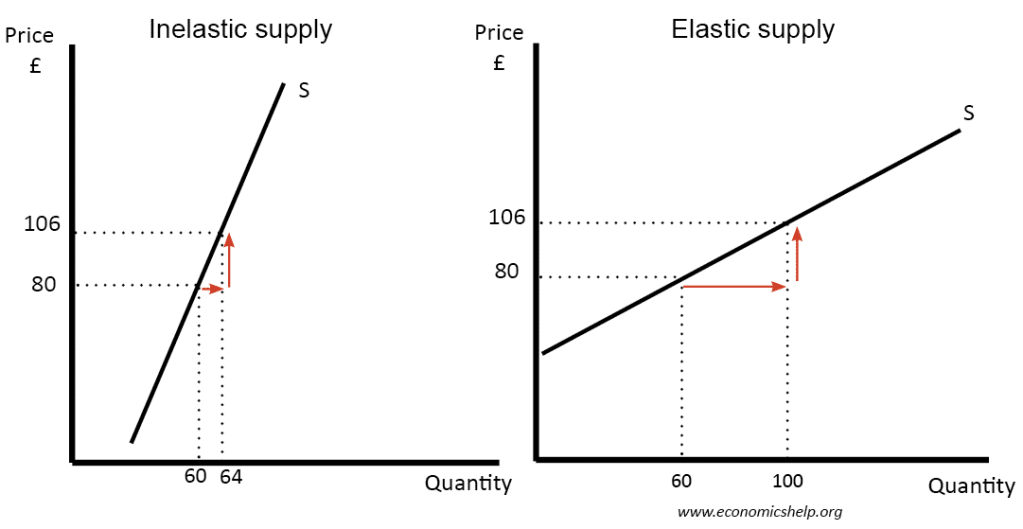

Supply of oil is inelastic in the short term, which means that relatively the same amount of oil is produced , regardless of the price as in this case, large increases in upstream investment is usually unable to produce a proportionate increase in supply. Disregarding factors such as political turbulence, weather and geographical challenges, it typically takes a large amount of time to develop new oil fields, involve in the exploration of oil fields and vary production as oil is a depleting resource and is extremely capital intensive and difficult to extract.. Oil is also sometimes found very deep and it is therefore not as easy to supply it as production capacity and the equipment used to extract oil is fixed in the short term. It therefore takes time to increase supply. However, once oil fields are developed, supply is increased, and prices will drop.

As seen in the figure below, in inelastic supply, as the price increase, the quantity supplied is very small in comparison to that of elastic supply.

Figure 3- Elastic and Inelastic Supply

WHO AND WHAT DETERMINES / FLUCTUATES OIL PRICES?

OPEC

The OPEC or the Organization of the Petroleum Exporting Countries is an organization that consists of 15 countries, that was formed to negotiate matters concerning oil prices and production. It controls over 74.9% of the world’s total crude oil reserves and is responsible for 42% of the world’s crude oil production as of 2019.

The combination of their dominance over the crude oil reserves and the OPEC’s low barrel production costs, provide them wide wide-ranging influence over oil prices. When there is less oil, the OPEC increases oil prices to maintain stable levels of production. When there is an abundance of oil, they cut back on their production quotas to ensure that there is a restriction on the supply of goods and that prices stay up. This ensures that the member countries are able to sell their products for enough profit and prevents the unchecked supply of cheaper goods.

By restricting production, the OPEC will be able to force oil prices to rise. In this way, they will be able to obtain greater profits. This was a common immoral strategy employed by the cartel during the 1980s.

An inherent advantage with how oil moves in the market is that since oil has inelastic demand, because of the member countries, the OPEC has been able to become a market power.

A market power can be defined as a company’s (or group of companies’) relative ability to manipulate the price of an item in the market via influencing the level of supply and demand.

An example of this is the fall of oil prices in 2014, which was attributed to the OPEC breaking their vow of keeping oil prices above $100 per barrel by refusing to cut oil production even with the lowered demand for oil in Europe and China. The excess supply caused prices to fall sharply to $50 a barrel.

Therefore, it is safe to say that the OPEC and its influence on the Oil Market undermines the principle of consumer sovereignty as it is the business that is influencing (partly only) how much of the commodity is being produced in the economy ( consumer demand is also a factor but the OPEC has wide influence on price).

SENTIMENT AND INVESTOR PSYCHOLOGICAL BIAS

Speculation and market sentiment are key factors in determining oil prices. This is based the fact that investors wither have this “belief” or analyse the “market sentiment”, to conclude that that oil demand will increase or decrease substantially at one point and will buy thereby buy or sell oil futures. This can therefore result in either a dramatic increase or decrease in oil prices.

This can therefore be associated with the phenomenon known as Herd Behavior where investors may or may not tend to purchase or sell oil futures depending on how rivals within the market behave. Market Sentiment refers to the overall consensus of investors towards a security or the specific market as a whole .

A study by Xin Li, ( crude oil as the focal point for its research) concerning the the Investor Psychological Bias, which focuses on aspects such as the over confidence bias and familiarity bias has been attributed to influencing the prices of oil. The study also states that existing evidence show that bounded rationality affects the trading, expectations and prices of these futures.

When these investors choose oil futures they tend to choose the ones that they are familiar with. This behavior has been defined as the FAMILIARITY BIAS.

It has been seen that investors tend to use past performance of similar futures and trends in these futures to guide their investing decisions. This has also been attributed to the overconfidence bias, where investors have relied primarily on sentiment and speculation in addition to previous success to guide their decision making. This has been seen to greatly impact crude oil prices, according to the study. The study concluded with the finding that investor psychological bias does influence financial commodity prices such as crude oil.

GEOPOLITICAL FACTORS

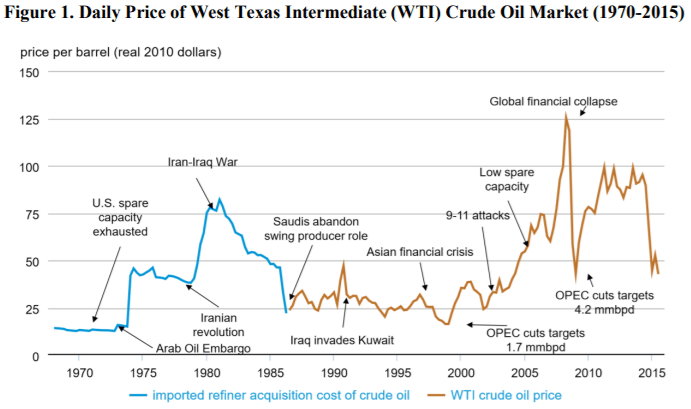

It should be no surprise that geopolitical and economic events have severe impacts on oil prices, as they have the potential to disrupt the flow of oil and products through the market. These events lead to times of great uncertainty about future supply and demand and therefore leads to high volatility in the prices. The graph above indicates how major political events around the world have triggered staggering oil price shocks due to supply disruptions. This is because some of the world’s oil producers are very unstable politically; some examples include the Iran-Iraq War and the Asian Financial Crisis.

In the case of the Global Financial Crisis, Oil prices fell from $147 in July 2008 to $33 in February 2009. Energy prices therefore fell due to diminishing demand, a contraction of credit with which purchases were to be made, and lowered corporate earnings which resulted in increased unemployment.

IMPACT OF LOW AND HIGH OIL PRICES ON STAKE HOLDERS

HIGH OIL PRICES

For oil exporting nations, such as the members of the OPEC AND THE U.S, this results in a increase in the real national income from higher export earnings. Oil importing nations on the other hand, will have suffer negative consequences as –

- They need larger amounts of energy to run the economy. This will results in a rise in production costs , which will in turn result in a rise of prices. This consequently results in increased inflation. Inflation can be defined as the sustained increase in the price levels of goods and services in the economy over a period of time. Oil prices and inflation therefore have a cause and effect relationship. This makes it harder for consumers in emerging economies where wages are flat and the rate of spending is increasing rapidly.

- Poorer oil importing countries such as the ones in sub-Saharan Africa, are in extreme need for oil and find it extremely hard to adjust to the financial conundrum created by higher oil prices. For example, due to the rise of oil prices in 1999, over 3% of the GDP of the countries ( sub -Saharan Africa) were wiped out.

- In general, this increase in fuel prices, result in higher inflation, a rise in production costs and reduced investment in oil-importing states. The Central banks of these countries, in anticipation for a general inflation in the economy will tighten monetary policy, which includes increased interest rates. As a result of this, banks would increase their lending and deposit rates.

- The pressure to increase wages due to the rise in the price of products coupled with a decline in demand result in higher unemployment rates. In addition to this business are placed in a horrible position due to lowered consumer spending and .

- The higher interest rates result in a decline in disposable income as consumers are too occupied managing debt.

On a general macroeconomic scale:

- Airline are damaged by the increase in oil prices as they now have to charge higher fares in order to adjust to the turmoil. However, as mentioned before, due to lowered consumer spending due to an increase in overall costs , people are less likely to utilize this service, which in huge losses.

- Impacts the fertilizer industry which requires oil and natural gas to manufacture their products. Farmers are therefore affected as it becomes harder to grow seasonal crops to the increase in prices of fertilizer.

- Transportation costs increase, which puts major pressures on transportation firms to increase prices to increase profits.

- Hybrid car manufacturing companies such Honda and Nissan utilize this opportunity to develop alternatives to gas-utilizing vehicles. This allows to invest into such hybrid-projects in order to prepare for oil price hikes in the future. They therefore invest in electric alternatives to maximize profits in the future.

LOW OIL PRICES

Just in time for examining oil prices we have the OIL PRICE WAR that is taking place between the OPEC and the OPEC+; in other words Saudi Arabia and Russia. Essentially, Saudi Arabia requested OPEC+ members (which includes Russia) to cut oil production by 1.5 million barbells per day, to stabilize falling prices of oil because of the economic turmoil caused by the corona virus outbreak.

Russia dismissed the idea and Saudi therefore decided to announce huge price cuts and aggressive plans to increase oil production from 9 million barbells to 11 million barrels per day. Russia therefore clapped back with a statement saying that they could increase production by 500,000 barrels to accommodate 11.8 million barrels per day. This has therefore triggered a price war between the OPEC AND THE OPEC+.

The current and future consequences so far? Lets examine

- The price of oil has dropped to record lows and Global stock market indexes have suffered major losses. On Monday itself over $110 billion was wiped of the ASX, making it one of the worst days for trading since the 2008 GFC. On Monday there was almost a 20% decline in Brent Crude futures prices , which is the global benchmark for oil, to $33.15 per barrel.

- Major oil producing countries are likely to lose at any cost with countries like Saudi Arabia needing to produce oil at $70 a barrel or higher at the least to keep up with government spending and the subsidies for citizens that they provide in order to balance their budgets. Increasing supply during a period of falling demand are likely to send the price of Brent crude down to below $30 a barrel in the second economic quarter.

- Countries such as Nigeria who are unstable and dependent on oil revenue have suffered in the midst. A fall in prices in oil, coupled with external debt and depreciating currency signify a risk to the Nigerian economy which is Africa’s largest. Their stocks plummeted for five days straight, starting from the 8th of March, to a four -year low.

A decline in oil prices heavily impact countries like Nigeria because they do not have major non-oil exports and also lack a “domestic manufacturing base needed to substitute for imported goods.”

- Politically unstable countries like Iraq, whose government is falling apart is likely to be heavily impact by the price drop as it is also significantly reliant on oil exports. The U.S is also likely to feel the hit as the price drop impacts the shale oil industries in Texas and North Dakota; in this case savings on petrol are unlikely to manifest into increased spending on other consumer goods. because of the “coronavirus led slowdown in global growth”. Therefore the likelihood of cuts in production are high.

PERSONAL OPINION

From the explored scenarios and consequences, there is only one thing that I can say and that is that dependence on oil is extremely dangerous. Given the highly volatile and desirable nature of this commodity, small fluctuation in the market can have repercussions that have a ripple effect across the global economy. Countries that cant exercise great power over this commodity and countries that are solely reliant on oil as a source of income via exports are highly vulnerable to this ripple effect due to the significance of oil in the global market. It can go on to impact a country’s GDP, their currency and coupled with existing internal conflict or debt, fluctuations in the price of oil can effectively cripple the economy. The fact that a simple change in the price of something can go on to impact everything from inflation to employment is astounding.

Given this “predicament”, is oil really the future to a sustainable economy? IS OIL FUTURE-PROOF? These are questions that are difficult to answer given how oil dictates a majority of movements int he market.

Therefore, it is the responsibility of countries and businesses to invest in evolving to occupy more sustainable and stable energy operations. Businesses need to start thinking about alternative energy sources to decrease their dependence on fuel, first and foremost, as it is one of the most widely used forms of oil. Economies need to generate ways to create, distribute and utilize new energy forms. Economies need to begin to create new sources of export incomes so that they are able to survive the erratic prices of oil.

Facts. Good read thomas.

LikeLike

Great work Shibu! Fantastic stuff once again.

LikeLike