You can’t play a casual game of monopoly. Playing a game of monopoly is a cut-throat, emotionally challenging journey. This game ends when one player has sucked out all the money he possibly can from every other player, and every other player is on the verge of tears. The question is, which one of them will you be?

The Link Between Behavioral Economics and Monopoly

A lot of people that have not had a lot of experience playing monopoly are susceptible to using a lot of heuristics or biases that can make them irrational (Where you make a decision that doesn’t maximize your utility or satisfaction) which can hinder their ability to win. This is where Behavioral economics links to monopoly, a lot of the behavior of people that lose in monopoly can be explained by concepts used in behavioral economics, and this guide will show you how you can avoid these mistakes and biases, and how you can even use these biases to SABOTAGE your opponents that will ultimately make you win!

The Bible of Biases and Myths You Should Avoid To Win Monopoly:

Mistake #1: “Prestige Bias: Individuals are more likely to imitate cultural models that are seen as having more prestige”

In monopoly, people generally think that the more expensive a property is, the better the property is. This is a result of prestige bias, where, where rather than actually looking at the rent of each property, players will tend to look at the colour and name of the property, and the big number that’s on the card, the price. All of which contribute to how prestigious the card is and therefore are used as a false indicator for how useful a card is. The prestige of a property (its colour and price) is not the best way to win monopoly.

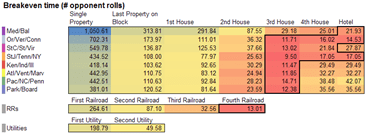

In fact, according to this table from amnesta.net, Pursuing the green set (The second most expensive set) is actually one of the worst sets to obtain in terms of the number of turns it takes to breakeven on the amount you invested. This is because of factors like the costs of houses and the fact that the probability to land on the green set is less than the rest of the sets. Orange and Red sets actually give the best returns because they are more likely to be landed on the board.

Mistake #2: Present Bias: tendency to rather settle for a smaller present reward than to wait for a larger future reward, in a trade-off situation.

When you finally get a monopoly set, DO NOT CARE ABOUT KEEPING THE MONEY YOU HAVE. A lot of people are afraid of spending huge amounts of money to invest in houses once they have gotten a full set. This is a result of overvaluing the present situation rather than thinking of the utility that can be gained from buying houses. The reason buying houses is important is because it is a source of income, once you lose money without investing in any houses, you won’t have any other ways of gaining money (apart from free parking) and you would have essentially lost the game. DON’T MAKE THIS MISTAKE.

Strategies to Help You Win:

Strategy #1: Anchoring Effect: A cognitive bias where an individual depends too heavily on an initial piece of information offered when making decisions

When trying to get the best deal in a trade a great way to get more returns is by using the anchoring effect. Where you can use the cognitive bias of people relying on the initial offer of a deal to your advantage. If you want to try and get a property off someone, offer a deal that includes their property and ALSO maybe some money or other properties. With the anchoring effect, the original deal that you intended to make where you just get their property will seem more reasonable to them and maybe you can even get more than what you wanted if they accept your offer.

Strategy #2: Endowment Effect: an emotional bias that causes individuals to value an owned object higher, often irrationally, than its market value.

Sunk Cost: a cost that has already been incurred and cannot be recovered.

People put a lot of value on the properties and sets that they own. Maybe its because of a emotional connection maybe its because of what they’ve sacrificed to get that set. You can take advantage of this because an opponent that has a green set can possibly value that set more than an orange set because of the endowment effect or sunk cost. This means in a trade deal between these two sets you will more likely end up with the better set because of an ‘emotional connection’ your opponent has with a green set. Easy!

Strategy #3 (Advanced): Framing: consumer choices will be influenced by how information is presented.

People will be influenced by the way you present your deals. If you can frame it in a way that appeals to any of the biases stated above, you can get yourself a very nice deal. Its very hard to refuse a deal of mayfair for two orange properties if you say that Mayfair is the most prestigious property in the game, it’s upfront value is more than the two orange properties and that it’s a better deal than the one that was offered before.

The result of all these biases and strategies is because of bounded rationality (The compromised rationality of consumers due to availability of information, complexity of a decision, time constraints and cognitive limitations.) and put simply, not a lot of people are willing to look at the statistics and strategies to ignore their inner biases. This is a good thing though! Because people that are sad enough to read about monopoly like me and you (because you’re reading this right now) will be put at an advantage because we can identify these mistakes. Keep monopolising!

Bibliography

http://www.amnesta.net/monopoly/

https://www.investopedia.com/terms/e/endowment-effect.asp

“Economics From the Ground Up”

nice one harry 🙂

LikeLike