What is the exchange rate?

The exchange rate is the value of a country’s currency against the value of another country’s currency. The exchange rate of two currencies are tied, if the value of one currency increases or appreciates, the value of the other currency will decrease or depreciate. The exchange rate of a given country’s currency is constantly fluctuating in relation to the economic situation of that country. The exchange rate is used every time goods or services are purchased internationally, and every time one currency is converted into another. An example of an exchange rate is 1 AUD being worth 0.73 USD (at time of writing).

Why does the exchange rate change?

It was mentioned before that the value of a nation’s currency is constantly fluctuating, this is because of trade and the concept of comparative advantage. Comparative advantage is the principle that each country has goods and services its specialises in, and because of this countries will engage in trade. If Australia is producing high quality goods and services that other nations are unable to supply themselves -such as iron and beef-, other nations will look to Australia as a source of these products. If people overseas are looking to purchase Australian goods and services, they will convert their own currency to AUD. This conversion of foreign currency into AUD means demand for AUD has increased. What is the effect of this increased demand? We know from supply and demand graphs that as demand increases, so does price. You can think of it as the ‘price’ of AUD increasing, as it costs/requires more foreign currency to ‘buy’ AUD (exchange into AUD), here AUD has appreciated. The opposite occurs when Australian’s are converting AUD into foreign currency such as CNY, JPY and USD, AUD will depreciate -this might happen when Australian producers cannot produce goods at the same or better quality than overseas countries can. The value of these foreign currencies will increase while the value of AUD decreases. In short, whenever a currency is converted into a second currency, the value of the second currency will increase while the value of the initial currency decreases.

The way supply influences an economy is more localised to within the country. If the supply of a currency increases i.e. the government prints more money, the value of each coin and bank note will decrease because there is more in circulation. Consumers have more money to spend but producers will adjust accordingly and raise their prices. This contributes to inflation, where the value of the currency has decreased in purchasing power. Looking at supply and demand graphs, an increase in supply results in a decrease in price, or value, of the currency. The idea of printing more money was implemented in Weimar Germany in 1923 and it resulted in record levels of inflation: 1.250 billion percent. One USD was worth 4,210,500,000,000 German marks.

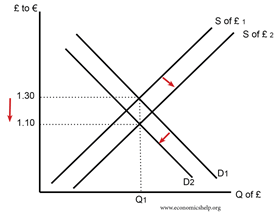

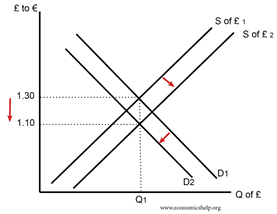

Here the demand for GBP has decreases while supply has increased resulting in a decrease in the exchange rate of GBP to EUR.

How does the exchange rate effect your life?

Individuals, businesses, and governments all use the exchange rate. You yourself will have used the exchange rate many times in your life whether you are aware of it or not, whether it was while you were travelling overseas, buying clothes online from an international supplier, or buying your brand new BMW from the local car dealership. The exchange rate is important because it dictates how much your Australian dollars are worth in another country. That holiday to Hawaii two years ago might be much cheaper next year. It’s not just individual’s who use the exchange rate, if you’re a business owner looking to expand overseas you’ll need to convert large sums of your local currency to the currency of the country who’s market you’re entering, in order to pay employees, rent land, or buy machinery. Government’s care about the exchange rate because it influences how willing other countries are to engage in trade with them, and trade greatly influences a nation’s economic wellbeing, but more on this later.

How has the value of the AUD changed recently?

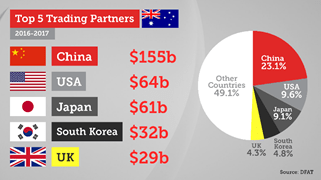

Recently the AUD has appreciated, at first glance this may be confusing given that Australia is currently experiencing a recession. The key here is that the exchange rate is not affected solely by the economic welfare of Australia, but also other economic environments of overseas nations. The value of the AUD is largely dictated by its major trade partners, the largest of which is China. This is because these are the countries that will be converting large sums of money into AUD. China was hit earliest by the virus and is now beginning to recover economically. Part of this recovery involves engaging in trade with its trading partners, such as Australia and the United States. When the economic situation and in the US are compared, Australia is fairing much better. The economic struggles of the US mean that China has increased its demand for Australian goods to offset the drop in supply from the US. In conclusion the combination of China’s recovery and the United States’ economic strife, have led the AUD to appreciate.

A more in-depth question: How does the exchange rate affect your country’s economy?

What do changing exchange rates mean for the national economy? Initially you may think that a higher exchange rate (AUD worth more) is good because it means that Australian’s receive more bang for their foreign buck, it is a lower exchange rate that is accommodating of economic growth.

This is not to say a higher exchange rate is without benefits. A high value of AUD will improve Aggregate Supply because businesses that reply on imported supplies will be able to purchase these supplies at a lower price of AUD, overall allowing them to reduce production costs, improving AD. However, this improvement in AD is not enough to offset the damage to Aggregate Supply when the exchange rate is high.

When the exchange rate is low, it means that Australian goods and services are cheaper to foreigners, encouraging them to import from Australia -increasing Australian exports (E in the AD equation). This benefits the economy because exports are an injection. If the exchange rate is high, it causes international competitiveness of Australian businesses to fall. A decrease in international competitiveness means that foreign countries will now look elsewhere to purchase goods that they previously would have bought from Australia, because Australian goods are now more expensive. This increase in the value of AUD means that Australians will increase their overseas spending because it is cheaper than buying locally, increasing imports (M in the AD equation). This is damaging to the economy because imports are a leakage.

Tying this all together, net exports is given by X-M (exports minus imports), and if the value of imports is greater the value of exports, this means net exports will be negative (known as a trade deficit) and will subtract from Aggregate Demand.

*Bonus tangent:

It should be noted that the exchange rate can act as a buffer for a failing economy. Let’s take country ‘K’. If K is struggling economically, the value of its currency will decrease seeing that K is not producing desirable goods for overseas investors. However eventually the currency of K will depreciate to the point that it becomes so cheap to import from K, that other countries begin to purchase K’s cheap goods, and this boosts K’s economy and K’s currency appreciates accordingly. Interestingly this buffer effect is one of the reasons for countries not to engage in joint currency. When Greece went into an economic crisis the value of its currency would have depreciated significantly EXCEPT that Greece uses the Euro, the value of which is influenced by all participating countries. As such, the value of the Euro did not depreciate enough for Greek goods to be attractive, and Greece did not receive the boost in demand it would have with its own independent currency.

Another in-depth question: How might a government influence the value of their currency?

Now we know how an economy is affected by the exchange rate, how might a government manipulate the value of its currency to manage economic growth?

A country can fix its currency or let it float. Floating a currency is where the government has minimal influence, letting the currency ‘float’ on the rise on falls of international demand. In contrast a fixed currency has high levels of government interference. A government will aim to keep the value of their currency within a certain range. This begs to question: how can a government fix its currency?

China is an example of a country with a fixed economy. China has experienced unprecedented economic growth and is currently the world’s largest exporter. It should follow that the value of the Chinese yuan (CNY) would be high right? Wrong. At the time of writing the CNY is worth 0.15 USD. How does the Chinese government do this? Remember that the value of currency decreases when it is converted into other currencies, and this is exactly what the Chinese government exploits by constantly converting enormous sums of CNY into USD and other currencies of its major trading partners. This mass conversion back into foreign currency cancels out the appreciation caused by exports to these trading partners. The result being that the CNY is fixed to these other currencies that it is converted to.

Why would China want to fix their currency? As mentioned above the massive exports of China would normally cause the CNY to appreciate, with the consequence of decreased international competitiveness followed by decreased trade followed by slowed economic growth. By artificially depreciating the CNY China ensures that Chinese goods and services are cheap, keeping the stream of foreign investment flowing. The result of this mass conversion of CNY to foreign currency means that China has large reserves of some of the wealthiest nation’s currencies, something that has caused concern for a number of governments that of the United States, but that is beyond the scope of this article.

Key points to take away:

- The exchange rate is the value of a country’s currency against the value of another country’s currency.

- If the value of one currency increases or appreciates, the value of the other currency will decrease or depreciate.

- A currency appreciates when demand for that currency increases, and depreciated when demand decreases

- There will always be a trade off between Aggregate Supply and Aggregate Demand when the exchange rate changes. A high exchange rate boosts AS and hinders AD, whereas a low exchange rate is boosts AD and hinders AS.

- The exchange rate is important to you on an individual level because it effects how expensive foreign goods and services are.

- If you are a business the exchange rate will influence how willing foreign consumers are to buy your products.

- Governments can influence the exchange rate if they wish.