Monetary Policy – What in the world?

Whilst the term may not seem like something you should know about, Monetary Policy forms the basis for some of the most essential concepts of finance that impact your everyday life.

The Reserve Bank of Australia (RBA) is the central bank that controls and implements monetary policy in Australia

Most central banks, including the Reserve Bank of Australia (RBA) have 2 jobs:

- To regulate and oversee the nation’s commercial banks by making sure that banks have enough money in the reserve to avoid bank runs.

- To conduct monetary policy, which is increasing or decreasing the money supply to speed up or slow down the overall economy.

But, how does the RBA change the pace of the economy? One of the major mediums include interest rates. The RBA in Australia sets the nation’s official interest rate, which is known as the cash rate. The cash rate is the interest rate at which banks borrow money (overnight loans) from other banks. This rate serves as the benchmark upon which the banks set up the interest rates for the general public that use their services, i.e- the rate of interest that you pay on your loans etc. If the cash rate decreases, the interest charged by financial institutions typically decrease and vice versa.

Why should I care?

The decisions that the RBA takes on interest rates directly impacts the prices of goods and services within Australia, the rate of unemployment and the health of the economy. In other words, monetary policy:

The decisions that the RBA takes on interest rates directly impacts the prices of goods and services within Australia, the rate of unemployment and the health of the economy. In other words, monetary policy:

- Dictates your wellbeing as a consumer, buying goods and services in the Australian Economy.

- Dictates your wellbeing as a consumer, buying goods and services in the Australian Economy.

- Dictates your wellbeing as a consumer, buying goods and services in the Australian Economy.

What are the general goals of Monetary Policy and in what shape and form does this take place?

The money supply can be defined as the total amount of money available in an economy at any point in time. This can exist in the form of credit, cash, checks, and money market mutual funds.

The primary goals of Monetary Policy are to control economic growth, unemployment, and most importantly- inflation.

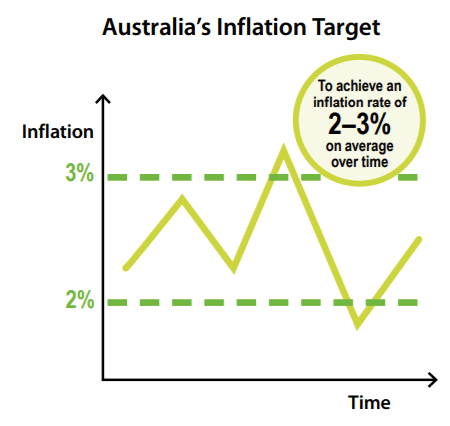

Inflation is the sustained increase in the general or average price level of goods and services over time. As inflation increases, the purchasing power, which is the amount of goods and services that can be purchased with one unit of currency, decreases; and vice versa. The RBA uses inflation targeting, to guide the decisions it makes regarding monetary policy. In other words, the RBA has flexible range in between which they aim to keep inflation levels. This range is 2-3% , where inflation can temporarily be below 2% or above 3% but should be 2-3% on average.

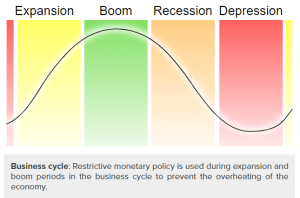

To manage macroeconomic instability such as high/low levels of inflation, and slow economic growth, the RBA adopts expansionary and contractionary monetary policies.

—————————————————————————————————————————————————————

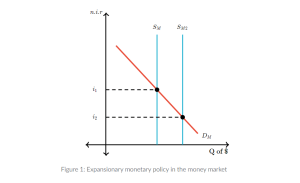

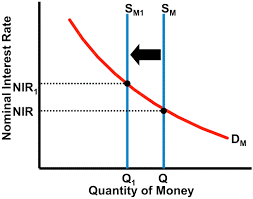

As the nominal interest rate (n.i.r) increases, the quantity of money demanded in the money market decreases (Q of $). Hence the negative gradient of the demand curve (DM). For the purpose of explanation, let the supply of money ( SM) from the central bank be completely inelastic, ie- the money supplied by the central bank is completely unaffected by any changes in the nominal interest rate.

Figure 1- Expansionary monetary Policy in the money market

Figure 2- Contractionary monetary Policy in the money market

During Economic booms and busts, monetrary policy is implemented to slow down and accelerate the economy, respectively

Expansionary Monetary Policy increases the money supply in an economy. This is done by the central banks to accelerate economic growth, when the economy is producing less than what it could at full capacity, or to tackle unemployment. Increasing the money supply, lowers interest rates which promote the growth of business investment and private consumption within the economy. Lowered interest rates make it cheaper for people and businesses to take out loans , which in turn leads to the greater expansion of businesses and in turn greater economic output. In Figure 1, the supply curve shifts to the right, thereby dropping the interest rate from i1 to i2.

Contractionary Monetary Policy decreases the money supply in an economy. Sometimes the output of an economy is greater than its potential output, which is the maximum amount of good and services an economy can produce at maximum efficiency. This is caused by a massive demand for goods and services and can cause an economy to “overheat” and this can cause an upward pressure on inflation. Hence , central banks decrease the money supply which increases interest rates, and thereby discourages business investment by increasing the cost of borrowing; and discourages private consumption by encouraging saving. This event usually decreases the output of an economy , thereby slowing inflation and economic growth. In Figure 2, the supply curve shifts to the left, which increases the interest rate from NIR to NIR1.

How do central banks change the money supply?

Central Banks change the money supply through 3 instruments:

- Open Market Operation (OPM): This act, at the simplest level, involves central banks buying and selling government bonds, which are debt securities that are issued to consumers to support government spending. Buying government bonds, injects new credit/cash into the system, thereby providing commercial banks with more money to loan out, consequently decreasing interest rates. When central banks sell government bonds, they are taking credit/cash out of the system, thereby decreasing commercial bank reserves and increasing interest rates.

- Discount Rate (DR): This rate, is the amount that the central banks charge commercial banks to borrow short term loans from them. Increasing the DR, would discourage this sort of borrowing from the Central Banks, thereby increasing interest rates, and contracting the money supply; and vice versa.

- Reserve Requirement (RR): This is the portion of the consumer’s deposits that the commercial banks must keep as cash, to cover withdrawals and other demands. Decreasing the RR, leads to more money being made available to the economy as it is no longer kept in the banks, thereby increasing the money supply. Conversely, increasing the RR, contracts the money supply.

Key Takeaways

- Monetary policy is the act of changing the money supply by central banks, to change the pace at which the economy is growing.

- Monetary policy impacts you by altering the employment rate, inflation, and the overall state of the economy.

- Based on measures of the standard of economic growth such as inflation targeting, the central banks employ expansionary and contractionary monetary policies to increase and decrease the money supply, respectively.

- Expansionary MP generally aims to accelerate economic growth and generally takes the form of low interest rates that stimulate private consumption and private investment.

- Contractionary MP aims to slow down economic growth to prevent “overheating” and generally takes the form of high-interest rates.

- Central Banks change the money supply through the buying and selling of government bonds (OPM), adjusting Discount Rates and adjusting the Reserve Requirements.