House prices in Melbourne have been rapidly growing for years, demonstrated by a 35% increase in the median house price in Melbourne’s metropolitan area in the last 5 years. This consistent growth is making it increasingly difficult for first homebuyers to break into the market, causing young adults seeking independence to rent for an extended period of time or buy a house in urban fringe suburbs at the expense of a long commute to the city. With interest rates at an all time low and the population projected to bypass Sydney within the next two decades, there appears to be no end in sight for first homebuyers.

Why are house prices so high?

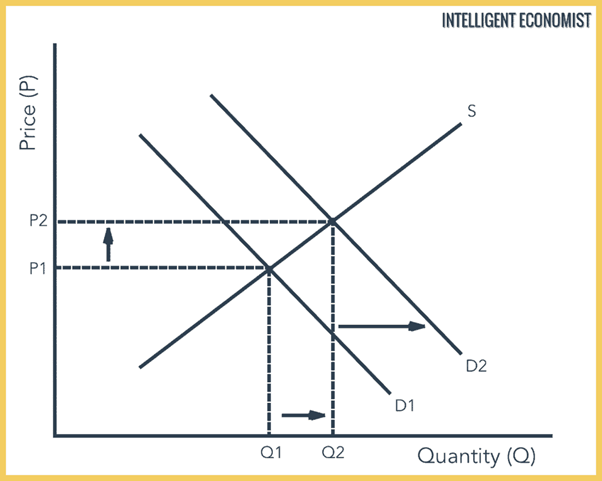

There is no singular reason why house prices are so high, it is instead a culmination of many factors with a main one being low interest rates. The Reserve Bank of Australia (RBA) has set interest rates at 0.75% in order to stimulate the weak Australian economy and encourage borrowing. This allows people to pay less interest on mortgages, causing an increase in demand for houses, which in turn increases house prices as more consumers are competing for the same amount of houses.

Another reason demand for houses is increasing is rapid population growth in Melbourne, with the metropolitan area growing at over 100,000 people per year. If this trend continues, Melbourne will overtake Sydney as Australia’s most populous city within the next decade, meaning competition for properties will only get tougher.

Other reasons for house price variations include politics and changes to bank lending rules. These are explored in the video below, which gives an insight as to why house prices changed in Australia’s capitals last year.

Why is this a problem for first homebuyers?

The biggest and most widely discussed problem with high house prices is the difficulty for first homebuyers to enter the market. House prices increase significantly each year, which gives homeowners a large advantage over first homebuyers. This is because the property owned by a homeowner increases in price according to how much the market strengthens, meaning they are essentially unaffected by large changes in the market as long as they buy and sell in the same market. The same can’t be said for first homebuyers, as an increase in prices widens the gap between them and homeowners, making it easier for them to be priced out of the market.

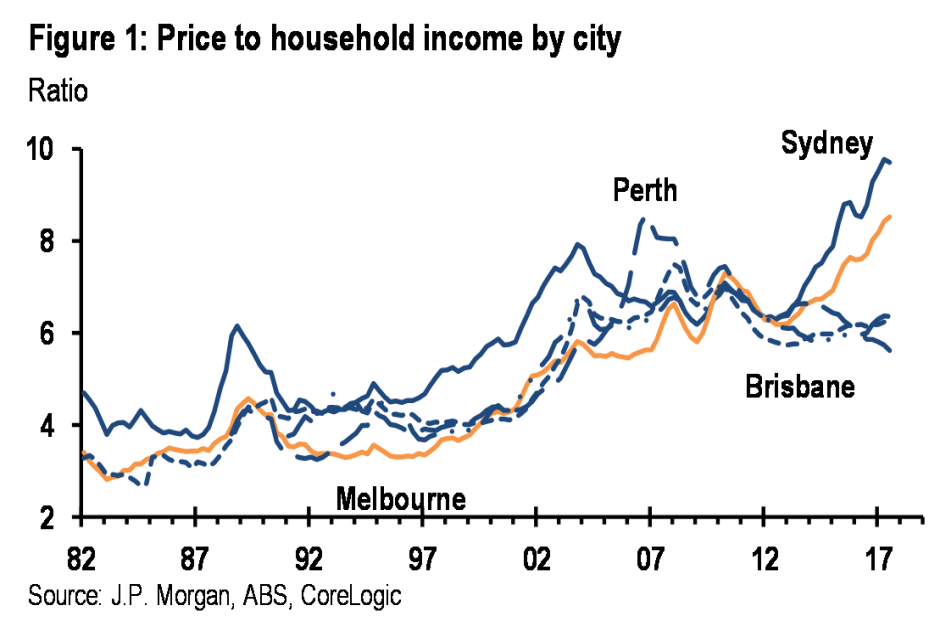

A quantitative reason for why it is so difficult for first homebuyers to enter the market is the Price to Income Ratio (PIR). In the early 1980s, Australia’s PIR was 3, meaning the average house price was three times the average household income. Today, Australia’s PIR is around 8, which means that Australia’s high house prices haven’t been caused by inflation alone, but also by the disproportion between house prices and income.

First homebuyers must rely solely on income to put a deposit on a house, causing many to elect to live with their parents for longer than previous generations did to save up for a deposit. This is an example of generational inequality, a growing concern in Australia with no clear solution.

Where are first homebuyers investing?

The increased difficulty to break into the property market has caused many homebuyers under 30 to look to many suburbs in the urban fringe. Research conducted by Credit Simple about mortgage application data from the first half of 2017 found that the most popular suburbs for homebuyers under 30 are:

1. Hoppers Crossing/Tarneit/Truganina (3029) – Median House Price (MHP) as of 5 Feb 2020: $530,000/$560,000/$573,500

2. Craigieburn/Roxburgh Park (3064) – MHP as of 5 Feb 2020: $527,500/$540,500

3. Cranbourne (3977) – MHP as of 5 Feb 2020: $500,000

4. Werribee (3030) – MHP as of 5 Feb 2020: $510,000

5. Caroline Springs (3024) – MHP as of 5 Feb 2020: $626,200

(Sources: Homely, Realestate.com.au)

All of these suburbs are over 20km from the city, and have a public transport commute to the city of roughly 40 minutes to an hour. Three of the five postcodes on this list are located in Melbourne’s outer-west, which contains some of the fastest growing communities in the metropolitan area. The MHP of most of these suburbs is between $500,000 and $600,000, which is around 30% lower than the MHP of Melbourne. As a result of many young adults moving to these areas, they have become more family friendly and their attractiveness to first homebuyers has further increased.

What does the future hold?

It appears that house prices will continue to rise for the foreseeable future, but the rate of increase is unsustainable. Hypothetically, if the trend of the last 30 years continues until 2050, Melbourne could have a PIR of over 20, which would make it practically impossible for first homebuyers to break into the market until they are well into their 30s. Some economists believe that there is a ‘property bubble’ in Melbourne, meaning house prices are inflated and will plummet dramatically once the bubble bursts. This would decrease Melbourne’s PIR and make it easier for first homebuyers, but it is unknown when the bubble will burst, or if it even exists. In the meantime, the government must try to find a solution and provide more assistance for first homebuyers, or run the risk of the generational divide spiralling out of control, alienating the country’s youth and significantly thwarting economic growth.

brilliant post

LikeLiked by 1 person

Hopefully the government can dedicate more resources to solving this issue

LikeLike

This is a very relevant topic especially for our rising generation of young adults. The rising price to income ratio shows how the government did quite little to restrain it. Very informative article!

LikeLike