Traditional banks have been controlling the monetary aspect of human lives for 500 years, but now there is a new kid on the block, radically changing the way people are banking. Offering much higher saving account interest rates, these banks are taking millennials by storm, with one of these novice banks having collected more than $100 million within 19 days of launch.

However, are millennials not making the right choice? After the hundreds of fraudulent cases against the ‘big four’ banks, why would consumers trust their money in these banks? According to an article written by the Guardian, NAB, trusted by millions of Australians, has been ripping off its customers by charging deceased customers account fees, signing people up to useless insurances and having high charges & poor returns for retirees. Westpac has also found itself in a similar situation, with the Australian Securities and Investments Commission (ASIC) fining them for irresponsible lending standards. However, Westpac is still amidst a legal battle with the ASIC. Similar stories aren’t foreign to the CBA and ANZ

“…With satisfaction scores for these banks sitting at an all-time low…”

Chris Bayliss, Judo Bank

A new generation of banks have arisen, known as Neobanks.

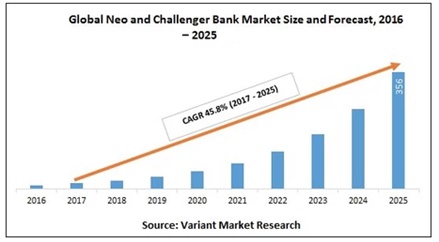

Neobanks are digital-only banks, offering new financial products which are promising to revolutionize the financial world. These banks offering fee-free, high-interest savings accounts have been highly debated in the media regarding their success in Australia as they have disrupted the financial market in the UK, Europe and North America, with the banks having collected capital worth more than $US3 billion within a few years of launch. However, this sparks the question, what impacts do these banks hold for the economy?

Being marketed for their easy-to-use and artificial intelligence (AI) incorporated apps, Neobanks provide consumers with AI-controlled saving goals, with the app automatically transferring a set amount of money to a separate account. Neobanks also provide users with monthly reports regarding their spending patterns, informing and educating users on good financial habits. Along with the added benefit of earning 2% more in interest rates than the ‘big four,’ consumer behaviour regarding spending is bound to change. This has already been witnessed by Judo, a Neobank launched in 2019, having collected $1 billion in term deposits since launch. Suffering from an already lowered economy growth rate, this decrease in spending, as money would be leaving the circular flow of the economy for a period of time, would decrease economic growth further, providing politicians with more incentive to allow for projects such as the Carmichael mine due to their economic benefits.

Neobanks also possess great potential to disrupt the property market. As Neobanks do not have any physical branches, their running costs are notably lower compared to traditional banks, allowing them to offer significantly more competitive interest rates on home loans. Their processes are also much simpler and faster due to their implementation of AI. This allows Neobanks to offer mortgages at a much faster rate with lower costs, making it easier for new home buyers and young adults to purchase houses. This could fuel the house price frenzy to a greater extent due to the increase in potential buyers. Additionally, this would also affect the ‘big four’ as they would be forced to lower their interest rates to stay competitive. This would result in a decrease in profits for the ‘big four’ gained through mortgages, heavily impacting these banks. This has been evident in 2019, with ANZ profit’s lowering by 7% due to the industry-wide lowered interest rates impacting their profitability. With the addition of more intense competition, profitability is projected to be lowered further for all four banks.

Thus, Neobanks could greatly influence the Australian economy, depending on their acceptance in our society. However, according to the prediction of PwC, with Neobanks capturing $US394.6 billion over the globe by 2026, there is clear indication that Neobanks are likely to change the face of the financial industry not only in Australia but worldwide.

Bibliography

https://www.abc.net.au/news/2019-10-31/anz-2019-full-year-results/11654618

https://www.business2.com.au/2020/01/what-role-will-neo-banks-play-in-real-estate/

Solid work, its evident that you’ve put in a lot of effort

LikeLike

I never trusted to big banks anyway!

LikeLike