The world is in shock.

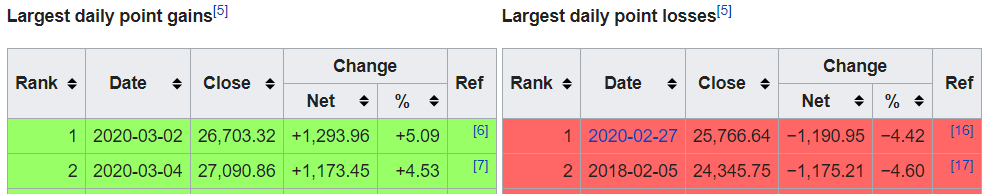

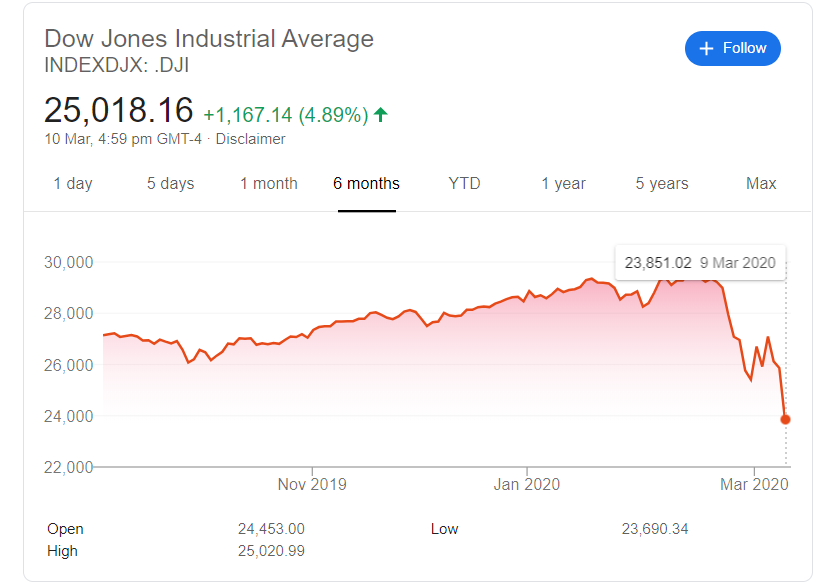

Over the last few weeks, the Dow Jones Industrial Index (DJI) has seen a period of volatility never ever seen before in the history of the world.

It seems doom and gloom. But history tells us otherwise.

- The 2008 Global Financial Crisis

- The 2000 Dot Com Bubble

- The 1980 Japanese Economic Bubble

- Black Monday — the Stock Market Crash of 1987.

Others were smaller… like the global mini-crash October 27, 1997, caused by an economic crisis in Asia.

So if traditional economics is to apply, why is there so much irrationality in a world run by perfectly rational homo-economicus?

My hypothesis?

That human nature, which in itself is irrational, explains both the consistent and volatile economic bubbles of both global and local markets.

But first, why does this matter?

Put simply,

Economics, the study of how individuals and collectives make choices will always be inadvertently forever tied to the study of markets.

In free-market economies, like Australia or the U.S, where consumers are able to make decisions about what, how, and for whom to produce (fundamentally consumer sovereignty),

Analyzing markets is basically economics.

Markets, on a large scale, are the cumulation of individuals’ choices and their interactions with the economy.

What we choose to buy, what businesses choose to make, what opportunities are forgone and what choices are taken… are the markets.

And stock exchanges is what to markets, is markets are to economics.

The stock market fundamentally describes investors’ confidence in the markets.

So in principle, if we begin to understand the patterns of the stock market, we can hope to bring clarity to the patterns of the economy, markets and ultimately human behavior (even though this is not always the case).

So on to my hypothesis.

Thinking Fast and Slow by Daniel Kahneman and Amos Tversky can be said to have pioneered the field of behavioral economics.

definition: behavioral economics

And these psychology insights are crucial in my analysis of how cognitive biases and irrationality affects the patterns of the stock market.

Behavioral economics brings one key insight that pertains to this blog; bounded rationality.

Bounded rationality…

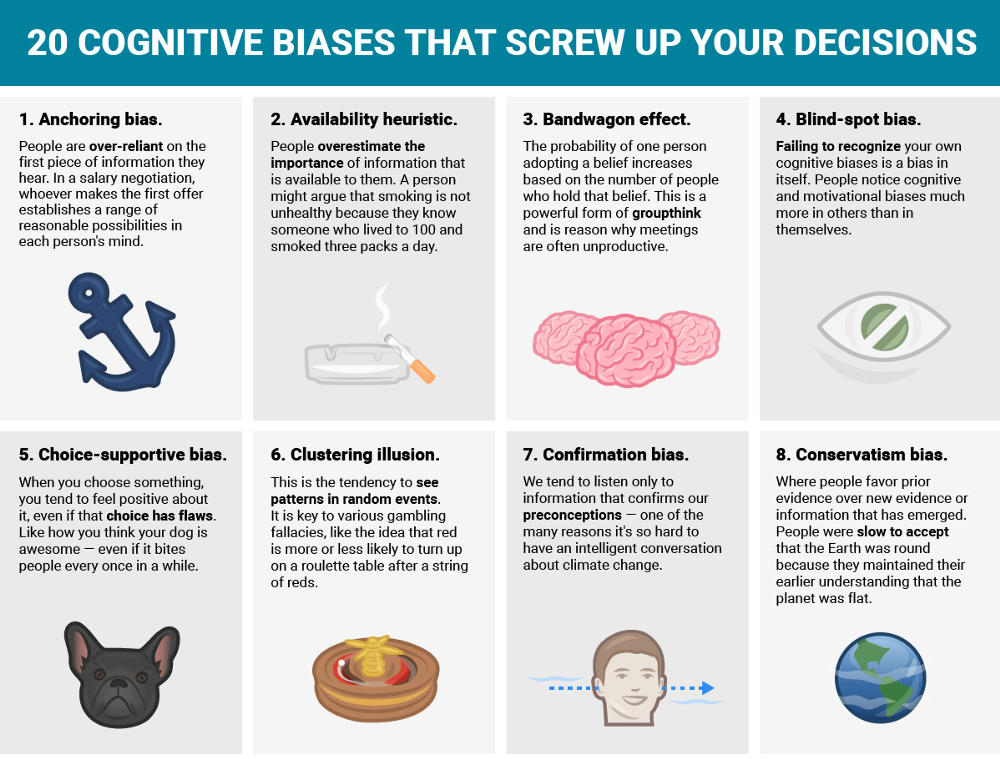

Bounded rationality theorizes that humans have a cognitive limit and that when decisions become increasingly complex we use heuristics (or shortcuts in thinking) to make decisions that are simply ‘good enough’.

These heuristics ultimately can be said to have been the cause of the irrationality and volatility of markets.

There are a multitude of different heuristics that humans use to function in an uncertain world, that include

- The Herd Bias

- Survivorship Bias

- Anchoring Bias

- Confirmation Bias

- Recency Bias

- etc….

So how do these heuristics affect stock market bubbles?

However, stock market bubbles don’t logically make sense.

How do hype, eccentricity, and emotions affect the decisions of humans that are meant to be perfectly rational?

If individuals were rational, market corrections and recessions would be nonexistent, with markets perfectly reflecting increases in productivity.

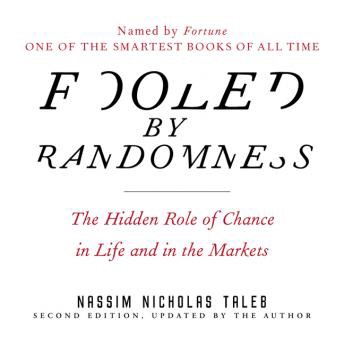

I think this quote from Fooled by Randomness by Nassim Taleb (accomplished trader) puts its perfectly.

‘if people were rational then their rationality would cause them to figure out predictable patterns from the past and adapt, so that past information would be completely useless for predicting the future’

Take this example from the book.

‘if rational traders detect a pattern of stocks rising on Mondays, then immediately such a pattern becomes detectable, it would be ironed out by people buying on Fridays in anticipation of such an effect’.

Evolution has to lead the human race over hundreds of thousands of years to form heuristics that were beneficial in a world of incomplete information. But now in our modern economy, they have become a deteriment.

Analysis of A Bubble.

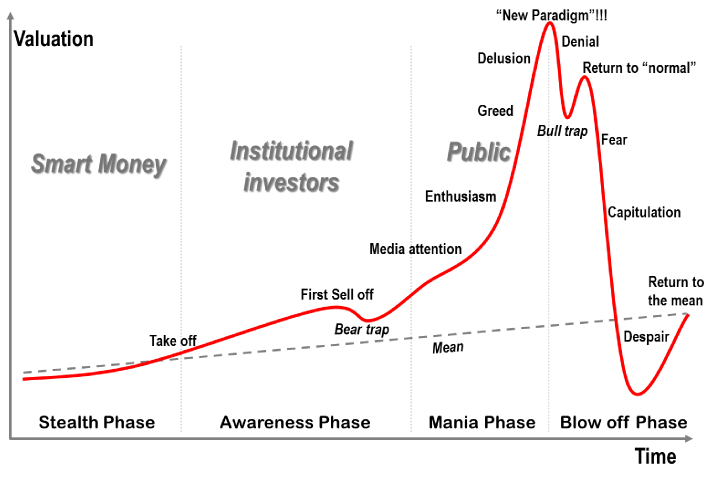

So what is the form of a stock market bubble?

As you can see from the diagram above, the mania phase can be described as the culmination of many different cognitive biases.

The Herd Bias.

This bias can clearly be seen as a part of a market bubble, described by other words such as ‘hype’, ‘market boom’, etc…

This greatly accelerates the adoption or purchase of assets, inflating their prices.

For example, in the global financial crisis with homes, in the 2000 tech bubble with technology companies, and even in commodities like the gold rush in Australia and California.

The feeling that we are missing out on the latest craze, be it bitcoin or the dotcom bubble, it reinforces this effect and leads perfectly capable individuals towards irrational decisions.

However, this effect is compounded with other cognitive biases such as the confirmation bias.

Confirmation Bias.

The confirmation bias is the tendency for individuals to disregard information that is counter to our preconceptions and focus on data that supports them.

We can see how this can be dangerous in a stock market bubble as individuals even though they have the ability to research and readjust, instead go about ignoring relevant information until the eventual market correction…

Combined with our tendency to be overconfident.

Overconfidence.

We also tend to be overconfident in our ability. Experts even more so. Which is perfectly summed up by these statistics.

Being overconfident in the case of the stock market causes even the best investors to make even worst decisions, doubling down on their position (making more purchases), or not putting in place pre-commitment schemes to prevent blow-up risk.

Even more biases.

There are countless biases during a stock market bubble that compound together that causes this frequent pattern that we seem to see again and again every few years.

Such as vividness (weighing emotions and feelings when making decisions), sunk cost fallacy/loss aversion/status quo bias (continuing an unfavorable decision as a result of previously invested resources), blind-spot bias, recency bias, survivorship bias…

A bubble is the perfect storm of irrationality when our feelings and heuristics prevent us from slowing down and rationally thinking about our choices, especially in something as important as our financial security.

So in understanding this concept how can we use it to help assist potential stakeholders?

Market irrationality affects one main thing.

Global and local sustainability.

Heuristics prevents us from making appropriate long term decisions and this has a massive effect not only on economic sustainability but also on environmental and social sustainability.

When we fail to rationalize our decisions, we inherently trade the long term for the short term and this has implications for everyone; governments, companies, and individuals.

Governments.

Governments potentially are the stakeholders with the most responsibility in this situation.

My belief is it is their job to protect us, when we can’t do it ourselves.

Stock Market Bubbles have a major effect on the economy and it puts individuals in vulnerable positions that harm the well-being of communities.

When individuals get lost in the hype of the latest craze, like crypto and potentially risk their life’s savings to become a ‘bitcoin billionaire’,

or even events like the 2008 Financial Crisis where banks privatized the gains and socialized the losses of their irrationality, ultimately harming taxpayers whilst lining their pockets.

However, the problem is that government officials are also fraught with irrationality, falling prey to shortcuts, and unethical behaviors.

It is not their job to extend the bubble by cutting interest rates in the hopes of continuing the status quo.

This will only make the fall harder when it comes.

Their job is to protect the people, however, even by my naive understanding I know it’s easier said than done.

Business.

Even as an aspiring entrepreneur, I believe businesses have a social responsibility to their customers.

Experts who are privy to knowledge, have the responsibility of using that knowledge ethically.

Furthermore, it is my belief that business who truly cares about profit should nonetheless be ethical because of it is more sustainable (a point made by a prominent silicon investor, Naval Ravikant).

Businesses should hope to avoid irrationality and greed, and build a business culture that supports forethought to truly obtain wealth.

Businesses that are built on bubbles aren’t businesses. They’re bankrupt…. — Khoi Nguyen

Individuals

Lastly… individuals.

And I believe this one is the group with the greatest potential.

Individuals should aim to think independently, to put forethought into decisions, but understand that we are fallible creatures that succumb to short term desires and emotions.

We have the potential and the responsibility to act more rationally, to make better decisions and to support our peers in doing so.

However, I’m not saying to never take risks.

“The biggest risk is not taking any risk… In a world that’s changing really quickly, the only strategy that is guaranteed to fail is not taking risks.” – Mark Zuckerberg

But instead to take risks that limit the chances of going broke.

So how can we limit our irrationality?

The best way I can put this is through a concept I learned in economics class called pre-commitments.

A precommitment is a strategy that is set up to restrict the number of choices available to one in the future.

Putting in place systems and precommitments when you are in a rational, unemotional state is the best way to hopefully protect yourself from irrationality. Especially in economic bubbles.

An example of this would be the Australian government pre-committing individuals to save for retirement through superannuation or turning off all your lights at 10 pm every night so you have to sleep.

The best way to protect yourself from fallibility, is to understand that you are fallible and put in place automated systems to force you to do the right thing.

So what are some systems you think you could implement in your life to stop yourself from irrationality, to limit the use of unproductive heuristics, and to make better long term decisions?

In conclusion

Unfortunately, stock market bubbles are here to stay.

Our irrationality is built into our DNA.

Heuristics are great, it helps us make decisions in an uncertain world. If we were all perfectly rational, it would be impossible to do anything, as we would fret about the endless possibility of every, single decision.

However, when cognitive shortcuts are combined with risks it becomes dangerous.

We should hope to put in place systems and pre-commitments that stop us from times of the irrational system. So what systems do you think you can implement? What are your thoughts on economic bubbles? and what do you think we can do at a corporate and government level to protect us from ourselves?

Bibliography:

https://podcastnotes.org/navals-periscope-sessions/naval-nivi-40/

https://www.forbes.com/sites/mikecollins/2015/07/14/the-big-bank-bailout/#4e9ee8222d83

https://en.wikipedia.org/wiki/List_of_largest_daily_changes_in_the_Dow_Jones_Industrial_Average

https://en.wikipedia.org/wiki/List_of_stock_market_crashes_and_bear_markets

https://smartasset.com/investing/stock-market-bubble

https://www.quora.com/Who-invented-the-stock-market

An Introduction to Behavioral Economics

https://en.wikipedia.org/wiki/Bandwagon_effect

https://www.smithlawco.com/blog/2017/december/do-most-drivers-really-think-they-are-above-aver/

Fooled by Randomness – Nassim Taleb

Thinking Fast and Slow – Daniel Kahneman and Amos Tsversky

Wow, this blog covers a lot, and it gives meaningful insight into how the bounded rationality of consumers creates perpetually-fluctuating stock markets. Speculative decision-making, panic selling, following the ‘herd’ and over-investing when things are looking good are the irrational decisions that each investor makes, and have profound effects on the aggregate economy.

Great stuff Khoi.

LikeLike