You’re probably sick (haha get it) of reading about coronavirus.

From rampant Aussies panic buying toilet paper to mothers spraying their children in antibacterial spray after school, it has people going crazy.

Coronavirus is scary.

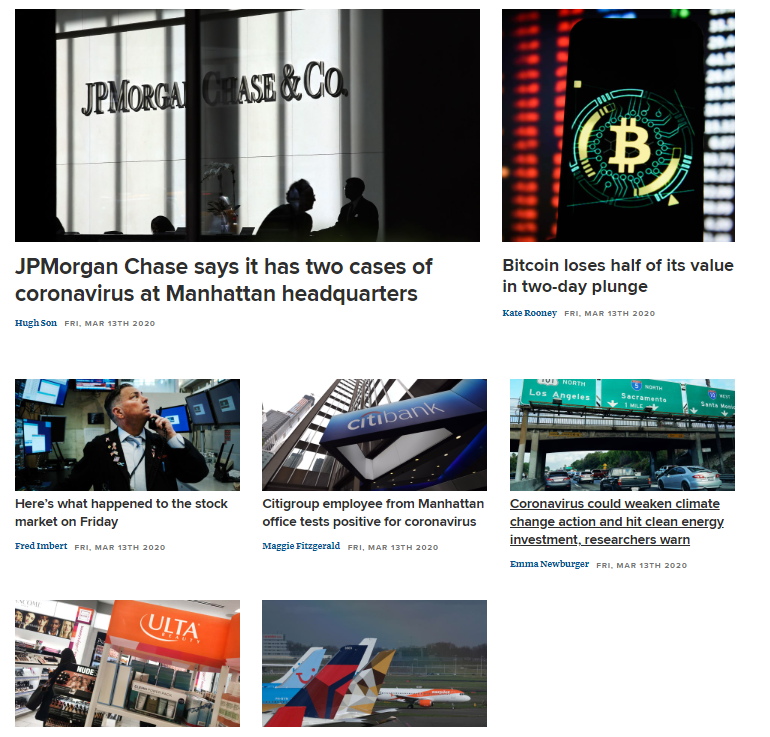

People worldwide are unsure about the effects that it will have on all aspects of their life, in particular, the financial impacts.

When you consider that virtually all economic interaction is contingent on people interacting with each other, coronavirus seems scary. Think about it: factories, warehouses, offices, shopping centres and markets can’t run without people working together and making transactions. Additionally, the virus stems from the second largest economy in the world, China. As a manufacturing powerhouse, Chinese businesses not being able to maintain or increase production is extremely detrimental to the world economy.

The Problem 😦

If I’m a working person and I don’t want to get sick, I’m not going to out to shops or restaurants. Multiply this mindset with hundreds of millions of people and there’s a massive hit in spending. This means there is a decrease in demand from consumers as going out to purchase products is now ‘risky’ for their health.

If I’m a business in a quarantined area or my government places restrictions because of coronavirus, I can’t produce as much or more than I used to if my workers aren’t allowed to come to work. Even if I’m not in an affected area, I am at risk of not receiving resources from other businesses because my suppliers are impacted by the virus. This means that there is a decrease in supply.

With both a drop in demand and supply, these are fewer sales and less production, leading to lower revenue and profit for businesses. This has shareholders scared.

Shareholders use profit and revenue to track whether their shares (percentage ownership) of the business will rise in value. If a business has more profit and revenue, it can use that extra money to expand and earn even more money, which means the value of the shares those shareholders own rises in value as well. This is called a capital gain- when a shareholder buys shares in a company at one point of time and the value of that share increases. With an increase in profit, shareholders also receive higher dividend payouts which are a portion of the company’s profits paid to shareholders.

Shareholders want more money- it’s their primary objective.

That’s why dividend payouts and capital gains matter. Nobody would invest in shares if they didn’t have a chance of becoming wealthier by doing so. Coronavirus increases the chance that businesses have less profit and revenue because there is decreased demand and supply. As a result, shareholders feel as if the shares they own will drop in value. Therefore, they have chosen to sell their shares.

By selling shares, there are more shares available for purchase in the market. Because the market is now flooded with shares that nobody wants to purchase, there is more supply than there is demand, meaning the value of each share deflates or lowers. Other investors see this and think, “Oh no, the shares I own are going to lower in value because everyone’s selling. I better sell right now to avoid further losses!” This pattern goes on and on, leading to markets dropping in point (dollar) value.

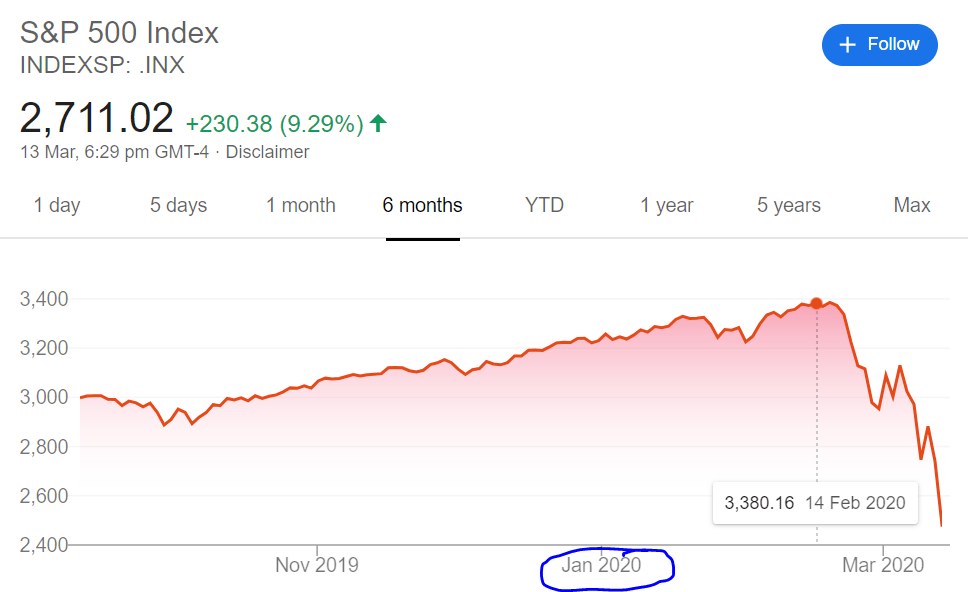

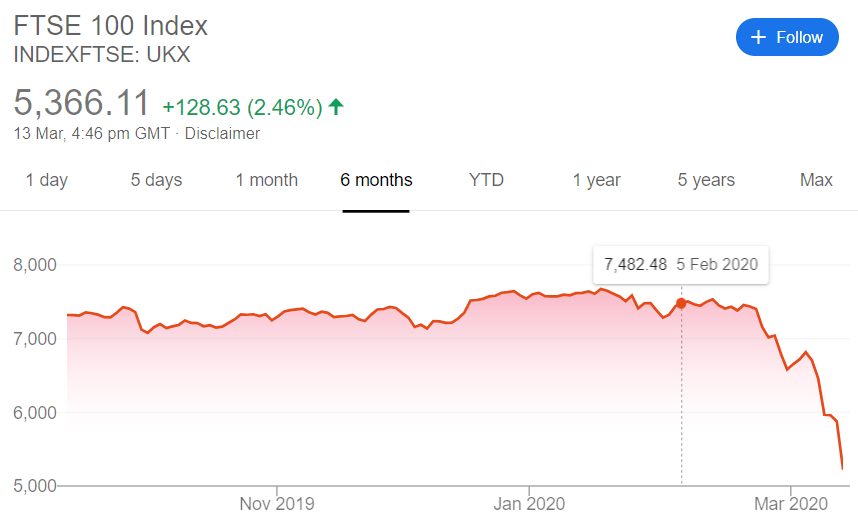

Sharemarket indices around the world have dropped in value.

Personally, the impact of coronavirus on the economy has a significant stake in my life. My parents both work as employees within a company and if that company must undergo foreclosure or lays off my parents, there is a significant income dent for my family and so, my lifestyle will be adversely affected. This same threat is present for my friends and family, so we may face difficult circumstances if the financial impacts become larger over time. However, I do believe that the financial impacts are a result of market irrationality.

Market Irrationality

Whilst everything that’s been said above about sharemarkets logically flows, it (to some extent) shouldn’t under traditional economics.

Think about it.

The only people that can control the value of shares are shareholders themselves. Investing in the sharemarket is not about what you think a company’s value is, it’s about what others think about a company’s value. Therefore, the market drop as a result of coronavirus is due to the irrational tendencies of investors.

The common decision making error that investors around the world are doing right now is succumbing to herd behaviour.

Herd behaviour: when people follow the crowd given decisions with uncertain outcomes with the hope that the crowd is doing the right thing.

Currently, because some shareholders are selling their shares because of coronavirus, other shareholders are selling their shares as well with the hope that those shareholders are making the most rational decision given the coronavirus threat.

Another common decision making error being made at the moment is succumbing to confirmation bias.

Confirmation bias: the tendency for humans to disregard information that opposes their viewpoint and focus on data/information that supports their position.

We can see this clearly with the coronavirus situation. Multiple studies, announcements and reports have come from scientifically credited sources that coronavirus is not a major threat to the world and is unlikely to be a major pandemic. Despite this, shareholders seem to continue to absorb information that supports their position that the virus is deadly and only worsen their rational capability to weather a potential recession.

This article further explores biases under the threat of coronavirus. Additionally, this article by Jason Zweig goes into excellent detail about how behavioural economics can be directly applied to investors at the moment.

My belief is that behavioural economics makes more sense when applied to the events occurring around coronavirus. Whilst principles of traditional economics such as of supply and demand are still seen, the assumptions of traditional economics simply don’t hold true in this context. The biases and influences on decision making (such as confirmation bias) under behavioural economics can be clearly seen in worldwide markets. Therefore, I will be using behavioural economics as the coronavirus pandemic continues to ensure I am forming opinions that are rationally sound and so I’m aware of my irrationality.

How to Capitalise on Coronavirus 🤑

Whilst most people are scared of coronavirus, selling their investment, you- yes you, can capitalise to become wealthy yourself. Whilst most people see market crashes as a bad thing, they provide an excellent opportunity to create wealth.

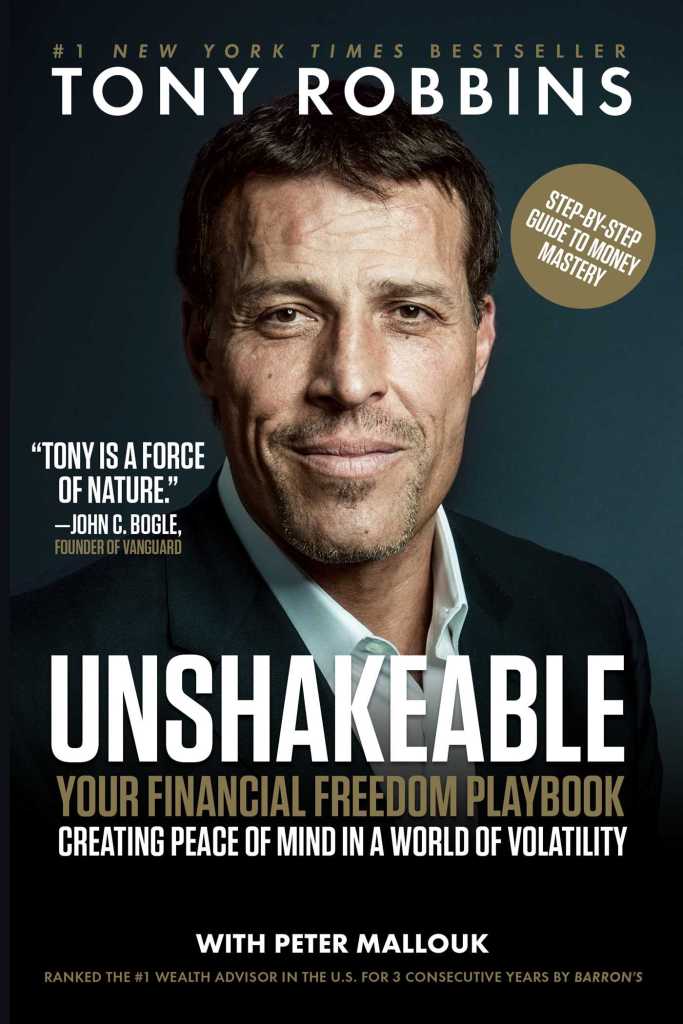

In Tony Robbins’ book, ‘Unshakeable’, he provides investment advice on how to become financially free. In the book, he addresses the issue of recessions/market drops with regards to investing. In my opinion, his take on drops in financial markets is an excellent idea to follow and act on.

If you think about it, all a recession means is that shares are going on sale. All of a sudden, markets are dropping in value, meaning shares are cheaper to buy. Additionally, because markets inevitably rise again (there has never and probably won’t be an instance of an economy that has a market decline indefinitely), you will get a larger capital return compared to shares at their ‘usual price’.

Let’s compare shares to eggs. If you bought eggs last week for $4 per carton, but now they’re on sale for $1 per carton, you don’t think to yourself “Oh no I’m such an idiot for buying eggs last week I got ripped off so badly, I’m never buying eggs again. In fact- I’m going to sell the eggs I own to avoid getting ripped off any further.” That’s ridiculous. What you would actually do is buy those eggs on sale and perhaps even buy a few extra because you can now buy 4 cartons for the same price as 1 carton last week.

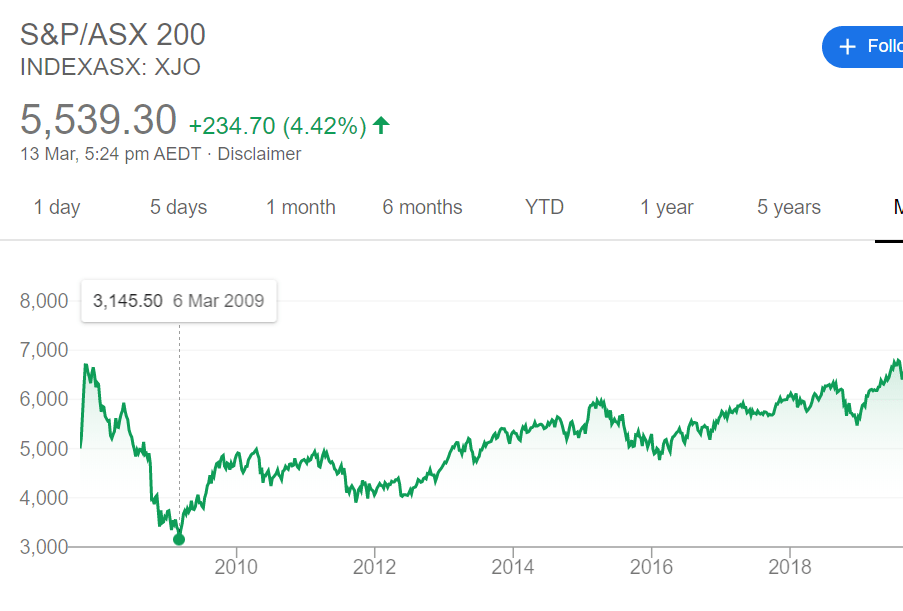

Apply this same principle to investing and you can make a fortune. Let’s use the example of the ASX in 2009 following the GFC.

With coronavirus, whilst most investors are heading out of the market, you should be choosing a time to get into the market so you get shares on sale for cheap! By buying low and holding (also diversifying and following other investing principles), you can earn fantastic returns on your money. This video goes into more depth as to what specifically you as a potential investor should do :).

Invest at the point of maximum pessimism. That is, the time to be most optimistic is at the point of maximum pessimism.

Sir John Templeton, Billionaire Investor

Coronavirus is causing investors to be pessimistic, but my outlook on it is mostly optimistic. For the first time in my life, I’m given an opportunity to increase my wealth dramatically and I can do something about it. The way I look it, I should capitalise on the market drops now more than ever because I don’t have a partner, a house, car or virtually any ‘real’ financial responsibility. Rather than spend my savings on hypebeast clothing or food, I can invest now to create a good foundation for my future financial success.

Conclusion

It looks like coronavirus won’t be gone for a while. From an economic standpoint, it has wreaked havoc on supply, demand and financial markets and the risk of a recession is getting more likely by the minute. However, it is also an opportunity for incredible financial growth if you play your cards right. I’ll be keeping a watch on markets and ensuring I make decisions and form opinions by considering the principles of decision making set out by behavioural economics. Hopefully, this ‘crisis’ will serve as a point of growth in my life rather than one of fear.

Thanks for reading <3.

imma sell me sum eggs on amazon

LikeLiked by 1 person

Imagine replying to Economics assignments at 1 in the morning 🤦♂️

LikeLiked by 1 person

It’s about time to stash some money into the stock market. There are a huge amount of different biases going on at play currently, and it’s interesting to understand how best to capitalize on it :)))

LikeLike

With the stock market seemingly so close to a crash, or even another Great Depression, do you think it’s still wise to keep buying stocks? And if so, what do you recommend as being the best investment?

LikeLike