What are interest rates?

Interest rates are fees that are charged when borrowing money, usually expressed as a percentage. If you have money deposited in a bank account, you will get paid interest for ‘lending’ your money to the bank. There are three types of interest rates, Fixed, Variable and Comparison. Fixed interest rates are set at a certain percentage for the duration of the loan. Variable interest rates change depending on the official RBA cash rate or the market. Comparison rates are used to determine how much the consumer would pay extra for a loan expressed as a percentage. Australia’s cash rate is managed by the Reserve bank of Australia.

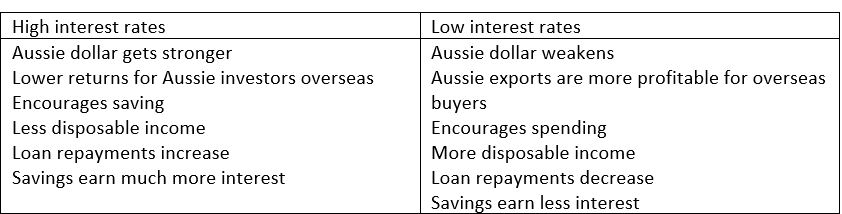

Effects of decreasing or increasing interest rates

Changes in interest rates affects the behaviours of the economy and individuals. As shown in the table below, higher interest rates causes the Australian dollar to surge and encourages people to save. Whereas, a lower interest rate causes the Australian dollar (hyperlink) to drop and encourages people to spend their money. Currently, the Australian dollar is at its lowest point in 5 years, 1 Australian dollar buys 66 US cents.

Recent interest rate cuts

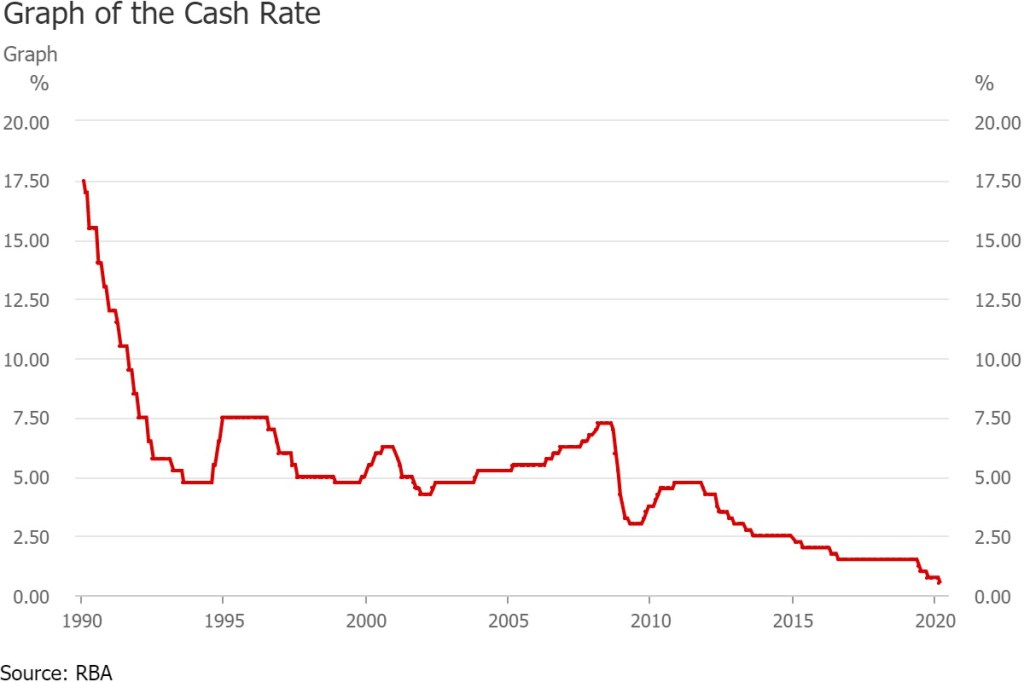

The RBA has cut interest rates four times over the past year, with the most recent cut on March the 4th 2020 where the cash rate was cut by a further .25%. The recent outbreak of coronavirus has influenced the decision to drop the cash rate, as stated in their recent media release statement.

Effect on stakeholders

Lower interest rates have benefited customers with home loans. A customer with a $500,000 loan would save $70 a month on loan repayments. This is making customers go against a common decision-making errors and biases – The status quo bias. The status quo bias is when consumers are adverse to change and will often stick to a particular choice even if it is not in their best interest. The drop in interest rates have encouraged consumers to shop around to find the best rates for them.

Personal opinion

Interest rates have been lowered due to the current state of the Australian economy. Will interest rates rise in the near future? It depends on how severe the coronavirus is and the level of economic activity in the future, but it is unlikely that the RBA will increase interest rates anytime soon.

Sources

https://mozo.com.au/interest-rates/guides/what-are-interest-rates

Good use of infographics to easily understand your points

LikeLike

I liked the graph of cash rate. Why was the interest rate so high in 1990 and before that?

LikeLike