Amidst the global pandemic, the attention of the world and its leaders have been solely prioritised in ensuring that we have the capability to fight off the inevitable economic and social consequences of the virus. A pivotal result of the emergence of COVID-19 is the dramatic negative demand shock on many goods and services. Without China, not only is there the stunted ability to manufacture the world’s goods, but also an international market that has shrunk due to the lack of demand from Chinese consumers. Such a case can be seen through the oil market where China is consuming an estimated 435,000 fewer barrels per day, but instead of seeing a decrease in production we are instead seeing the opposite- a dramatic increase of supply from Saudi Arabia and Russia. The reason for such a paradox lies with the Saudis and their reluctant realisation that they are unable to bully the global oil economy for much longer. In this article, I will divide the current oil price war between Saudi Arabia and Russia into its essential components needed to understand the issue.

Key Idea #1: Law of Supply and Demand

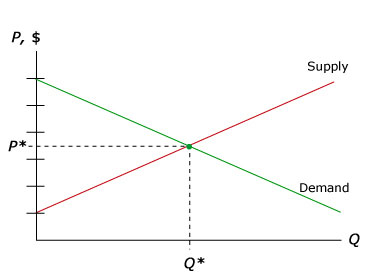

A businesses’ main priority is to provide profit for its stakeholders, in order to do that it must maximise its revenue. The business is willing to supply as many goods as possible considering that the consumers are buying their products. By selling as much as they can the business can bring in as much profit as possible. As supply increases, the price also increases, this is known as the law of supply. This must be used in conjunction with the law of demand- as price increases demand decreases- to understand the equilibrium point where both consumers and businesses are satisfied. Such a concept logically concludes that as demand decreases either the price must also decrease to bring in a larger market- unlikely in the oil scenario- or a decrease in the amount that is supplied. By decreasing the amount that is supplied businesses are still able to bring in profits without having to decrease their oil prices needed when there is an oversupply of oil. Such a concept is necessary for understanding the price war as it allows us to understand the perspective of the Saudis. By wanting to reduce the overall production of oil from most major oil producers through the Organisation of Petroleum Exporting Countries or the OPEC Saudi Arabia hopes for oil prices to remain consistent even with the negative demand shock.

Key Idea #2: Market Power and Competition

Saudi Arabia has been the oil behemoth of the world for centuries, its incredulous supply of oil from its reserves allows itself to be a large player in the oil market ensuring their market power. In combination with other OPEC members, the OPEC form an international cartel, one that can fix the price above the competitive price. This organisation can do so due to their large stake in the supply of the resource and can, therefore, set price and production levels. Such an economic structure can be labelled as an oligopoly- a market dominated by only a few producers or sellers. In an ordinary oligopoly competition- a condition where businesses clash with each other in order to obtain a larger section of the market- is limited but can still exist, such businesses are unable by law to collude and set prices collectively. However, in an international scenario, individual countries have no powers to prosecute and convict those who undergo antitrust schemes. Therefore, for a certain period from the conception of the OPEC, the countries were able to cooperate and agree on the price and production that each country would produce in order to keep oil prices high to grant greater revenues.

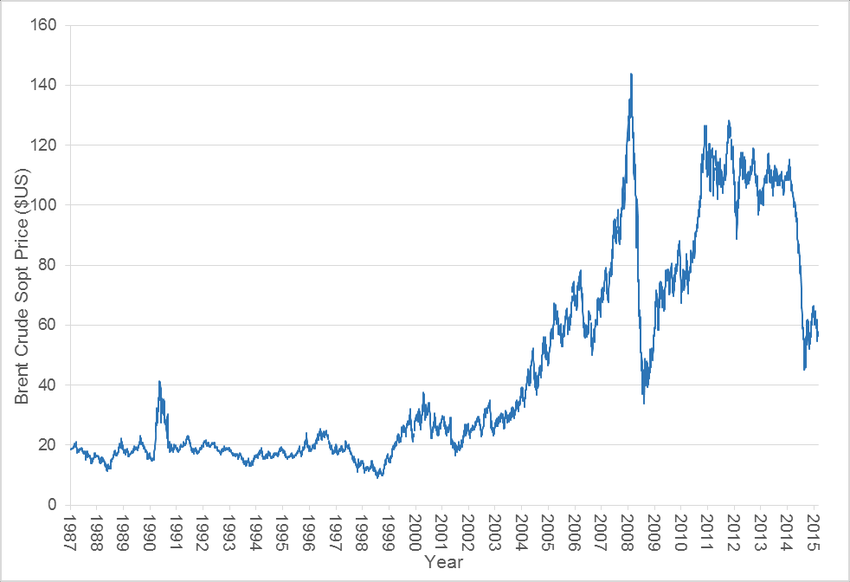

Within this oligopolistic structure of the OPEC, however, occupies a different element than usual oligopolies and cartels. Inside of the OPEC lies a swing producer, Saudi Arabia, who produces around a fifth of the world’s total oil, their power within the organisation is immense, relatively capable to keep the members to conform to their quotas. In 1982 where oil prices fluctuated due to geopolitical events such as the Iran-Iraq War, Saudi Arabia’s proposed quotas were being completely ignored by OPEC members. This is due to the simple explanation that by producing more oil than the rest of the market, countries were able to garner more of the market share. In addition, with the new quotas there would be less oil flooding the market which would entail that any extra barrels that is sold would be sold at a higher price than if the quotas for each country was lowered. Saudi Arabia, attempting to set the example by cutting its product by a third still had countries unwilling to commit to the quota. Therefore, similarly to what is occurring today, Saudi Arabia cut its prices drastically and increased its production, allowing countries over the world to buy oil at an exorbitantly cheap price.

The Changing of the Guard:

Due to the inadequacies and unreliability of the Persian Gulf to produce oil – due to their tendency to be involved in geopolitical conflict- the world requires countries such as the United Kingdom and more notably the United States invested heavily into energy alternatives including natural gas, coal, and ethanol. Although, these plans were effective enough, with the US only consuming 11% more from 1980-2014, oil has never become defunct due to its immediate efficiencies. The US, unwilling to part with oil yet also unwilling to deal with the middle east, had invested heavily into its energy sector wherein 2014 their efforts have paid off with its shale-oil industry expanding rapidly helping the US achieve the title of the world’s largest oil producer. This no doubt is also a factor in Russia’s decision in rejecting the quotas set by Saudi Arabia. By lowering production as Saudi Arabia wishes, Russia believes that this will inadvertently support the US shale oil industry, as when production lowers, the price of the world’s oil increases. Which funds other oil producers, putting more and more oil fields to appear in the US increasing its market share. Russia, desperately attempting to hold on to its oil money where it produces 12% of the world’s oil and saw 96.6 billion from crude petroleum alone, has also had its production halted by US involvement with Europe deliberately stalling essential infrastructure from being built. Thus, Russia is no longer willing to follow Saudi Arabia due to its self-interest with its exports in mind.

Consequences of the Price War:

A price war between these two countries has several critical consequences. A positive effect from the price war is that as the price of oil is low, those purchasing oil for their daily use benefit greatly, as the burden of expensive petrol has been lowered. The positives stop here, countries in Africa and the middle east, like in the case of 1982, will greatly suffer. Their inability to sell oil will directly lead to the inability to produce goods for their citizens. Countries such as Venezuela, Gabon and Iran are hit directly as not only has the virus stunted their revenue but now they have to compete with the endless supply of oil that Russia and Saudi Arabia has. Such a conclusion can also be seen in the US with its firms, as Russia and Saudi Arabia drop the price of oil, US companies have been devastated and workers in the midwest have been laid off because of it. These oil companies which are unable to support its workers due to the price crash, however, are quite small, larger companies such as Exxonmobil are expected to survive the war, such a conclusion will mean that the US oil market although weakened will not be destroyed, much to Russia’s chagrin. Russia’s diversified export portfolio will mean that the effects of the price war will have lesser consequences as it can depend on its other goods. Saudi Arabia, however, is quite the opposite with 90% of its exports concentrated in petroleum and petroleum-related goods. Despite, this Saudi Arabia is also able to price its oil at a lower price than Russia due to its vast resources, even to the detriment of its budget. With these two pieces of information, Saudi Arabia still has an abundance of oil to oversupply the market, and Russia although does not have the same ability to reduce costs can still rely on their other exports, the price seems to be a war where both sides are willing to fight until the last breath.

The price war, clouded from the public due to the media’s obsession with COVID-19, between these two countries is an unprecedented event in the oil market, an event that will forever change the landscape of the global market of oil. An incident that has the potential to break OPEC forever and finally see the dissolution of Saudi Arabia’s hold on the market.

Very nice Will! Good analysis of the “trade war” between SA and Russia, and its implications for the global economy.

LikeLiked by 1 person

Truly exciting information, maybe a reference historic precedent of similar price wars could be used to compare and contrast this current situation to others.

LikeLike