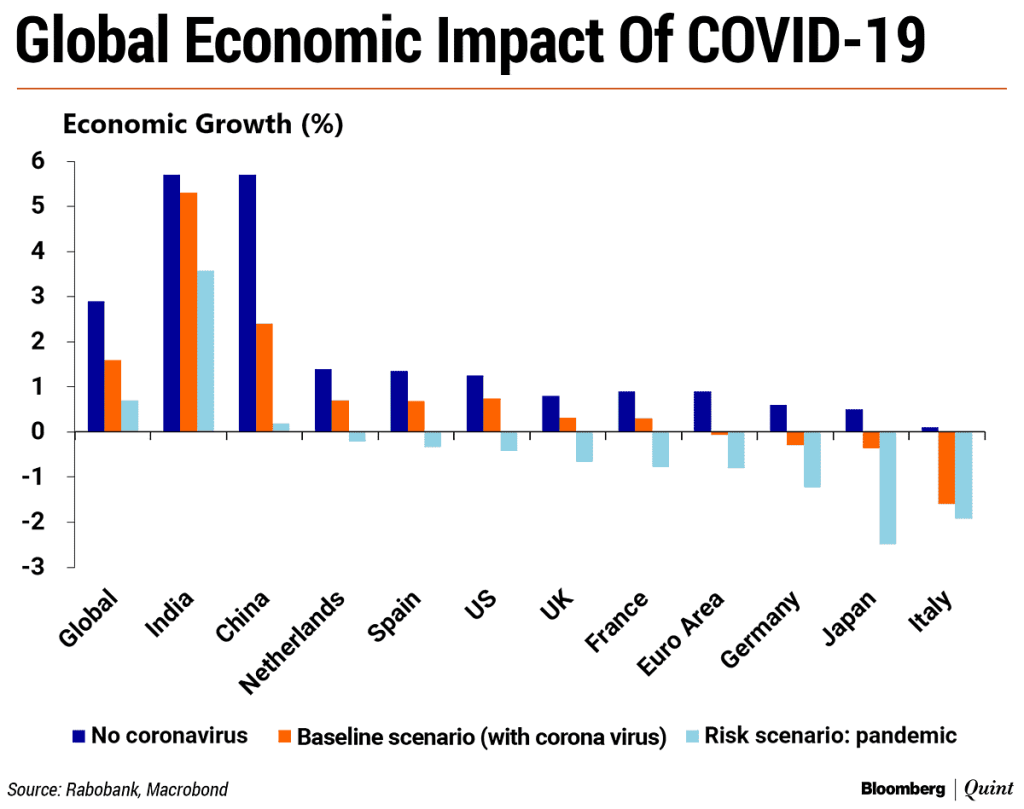

We have all heard about the severity and intensity of the coronavirus, either from the horrifying stories of the toilet paper crisis or the lockdown of millions of people in Italy. The pandemic is being compared to the Global Financial Crisis, with the correction of the stock market having wiped off more than $400 billion from the ASX over the past month. Consumer spending is at its lowest, as consumers are making decisions with rationality and utility, maximising their utility by only purchasing essential items in a time where the economic stability is comprised. Businesses are adopting the same mentality, by laying off casual workers and limiting hours for permanent employees as sales have substantially decreased, resulting in a decreased need for staff. All of these factors have contributed to an economic crisis in Australia, where small businesses are suffering the most.

As of 1 July 2019, a business is considered to be small if it meets two of the following criteria:

- an annual revenue of less than $50 million

- less than 100 employees at the end of the financial year, and/or

- consolidated gross assets of less than $25 million at the end of the financial year.

Most family-owned and operated businesses identify in this category, where they rely on monthly sales revenue to ensure the continuity of not only their business but also the livelihood of their family. Restaurants, retail stores and tourism-based businesses are predicted to be the most affected by the coronavirus due to the Vividness of consumers. Vividness states that consumers undermine the significance of scientific research due to a personal connection telling otherwise. Due to the exaggeration of the coronavirus within the population, friends may tell each other, ‘Don’t go to Box Hill to get food, you will get corona.’ This thinking within consumers has resulted in some small businesses having their income contracted by 80%.

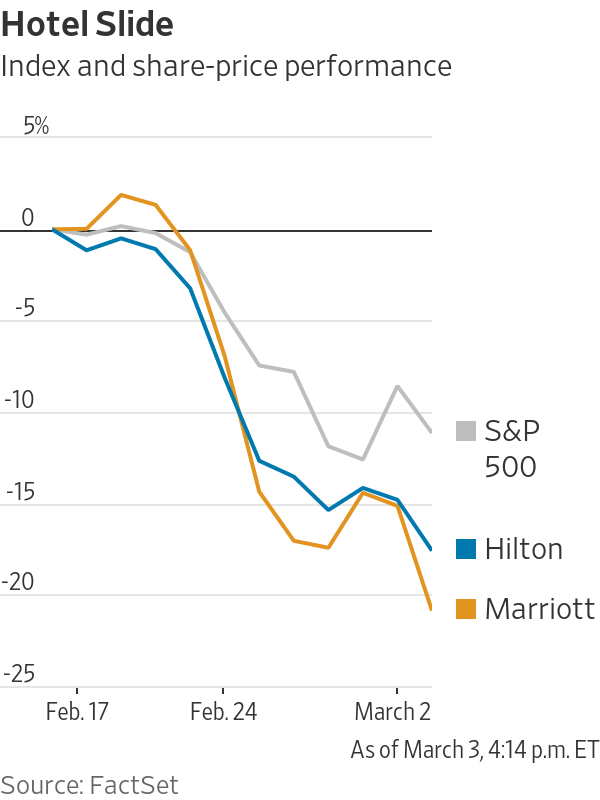

Businesses which rely on imported material/stock for sales and services are unable to obtain the required goods as China; Australia’s biggest trade partner has been under a travel ban for the past month. This has resulted in a shortage of supplies for business making them unable to generate profit from sales. Businesses which export their goods to China have also been greatly affected, where some wine companies have seen a significant decrease in their sales as China was the one the biggest importer of Australian wine. Businesses which have been affected by the bushfire crisis in late 2019 and early 2020 are the greatest impacted. Tourism-based, specifically motels and lodges had been previously affected due to the danger of the bushfire, resulting in hundreds of bookings being cancelled during the peak holiday period and now the travel restrictions have resulted in a further decrease of bookings. This has also impacted the economy which was expecting a $4.5 billion decrease in the industry back in January. This has likely now increased to a much greater extent.

The owners of such businesses are undergoing a huge economic crisis. They do not have the cash reserves to meet operation requirements such as mortgage repayments and purchase of inventory, which is now putting the life of the business at risk, as these businesses are falling towards bankruptcy. This will result in a degraded quality of life for thousands of families who relied on the income generated by these businesses. An interview conducted by the ABC has revealed that parent owners are worried about being able to meet school fees and other expenses of their children.

Workers of these businesses will also be affected as the businesses can no longer afford to pay wages to their employees, resulting in an increase of the job insecurity. 1 in 4 workers in Australia are casual workers who have had their working hours decreased significantly or completely cut as witnessed by employees of Flight Centre. The economic strain from a loss of income stream for these families will be depicted by a decrease in consumer spending which will in return decrease the GDP further. Unemployability rate may also increase if many businesses declare bankruptcy as they would be forced to fire all staff, adding further strain on the government in the form of Centrelink Payments. With a reduction in income and GST collected for the government, this strain would likely be highlighted by an increase in national debt.

This crisis has also opened up the possibility of business owners losing not only their source of income but also their homes as many owners take out loans with their personal home as security for the bank. Due to the lack of cash as previously explained, consistent defaulted mortgage repayments or bankruptcy could result in banks taking their homes. This could be even worse for the economy as the same scenario started the GFC in 2007. As the banks would try to sell these collected properties, there would be a sudden increase in the number of houses on the market, causing property prices to fall, due to the supply being greater than the demand. This could bring the housing unaffordability problem under control, however, this would not only be a negative improvement for the economy, as the GDP growth would decrease due to the reduction in Stamp Duty and property-related taxes such as land tax being collected. Although, this also puts banks at a risk of bankruptcy as they may not have enough cash to sustain themselves in the foreclosure and settlement period.

Businesses who have not been directly affected by Coronavirus do still possess the possibility to be affected by Covid-19. This would occur for owner-worker businesses such as barber shops that require the owner to be involved with customer dealings due to the clientele having based a level of trust and personal connection with the owner. If the owner of such businesses was unable to work for two weeks as they had to self-isolate due to coronavirus, they would be unable to generate any sales for at least two weeks, which could possibly leave their families being unable to afford necessary items such as food or accommodation if the owner does not have enough savings. It could also affect the customer base as some customers may permanently move to competitors, affecting the business over both short and long-term. Owner of such businesses are at a greater risk of contracting the virus as they deal with multiple people in a public place, substantially increasing their chances of succumbing to coronavirus.

The government has introduced a $17.6 billion stimulus to help small business combat this economic crisis. One of the largest benefits of this stimulus is that the government is boosting cash flows for employers by providing a capped $25,000 over six months to help cover expenses to eligible business. This is predicted to support 690,000 businesses. The government is also increasing the limit for asset depreciation deductions for a small period of time to encourage businesses to invest, however, due to the lack of cash reserves for most businesses, this will only be beneficial for very businesses. Although, the initiatives taken by the government are injecting money in areas where the economy would be simulated due to investment from the population, lowering the chance of the predicted recession and the severity if it does occur.

The extent to which this stimulus will benefit small businesses is still undecided due to the recent announcement of the stimulus. Nonetheless, it is clear that small businesses and owners will be greatly affected by the Coronavirus.

Bibliography:

https://www.bankofengland.co.uk/knowledgebank/how-does-the-housing-market-affect-the-economy

https://www.smallbusiness.wa.gov.au/blog/preparing-your-business-against-coronavirus

https://asic.gov.au/for-business/small-business/

https://www.theguardian.com/business/2020/mar/11/uk-small-businesses-impact-coronavirus-sick-pay

https://www.abc.net.au/news/2020-03-09/coronavirus-looms-as-catastrophe-for-casual-workers/12039154

https://www.rba.gov.au/education/resources/explainers/the-global-financial-crisis.html

https://thenewdaily.com.au/finance/consumer/2020/03/13/flight-centre-branches-close/

hot

LikeLike

It’s weird to see the major hotels like Marriot being so heavily affected by COVID 19.

LikeLike