Over the last few months, Australians have gone through so much. From starting off the next decade in a blaze to the recent and ongoing coronavirus epidemic. Global pandemics have caused much uncertainty in the future of the global economy, with the NYSE plummeting to its lowest since 1987. This has given rise to widespread panic in society, influencing crucial investment decisions that could potentially impact economies, as well as individuals for the better or for the worse.

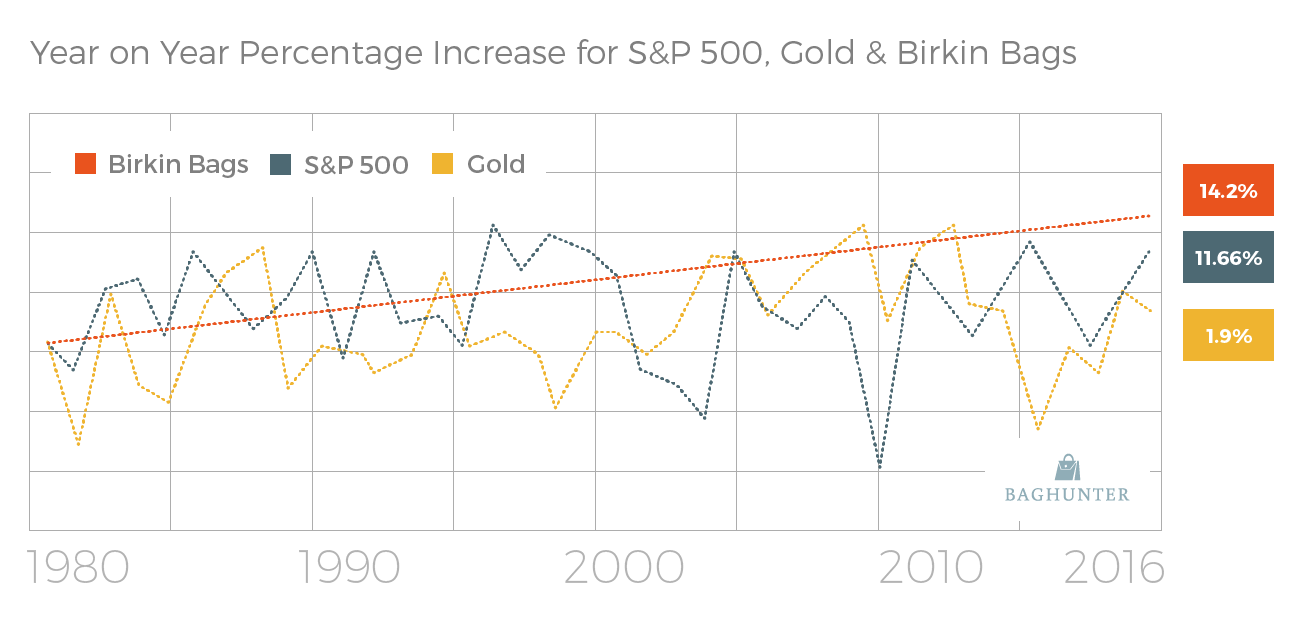

Economists of the contemporary world, state the best long term investments range from investing in stocks and cryptocurrency, to the real estate market, and gold. During pandemics and global recessions, stock markets and real estate may not be the most feasible of investments. In times of crisis, investors are always looking towards a safe investment. Although, most investments will get a return of some value for the investor, there is always a strong desire to for one to maximise their profits. The best, safest and most rewarding investment, that has been proven to outperform all others over a tested 35 year period, is none other than a French designer bag.

The iconic Hermes Birkin Bag has dominated the covers of fashion magazines, and has resulted in record-breaking sales. This has culminated in it gaining the moniker of the most desired line of handbags on the planet to this day.

The average person invests upwards of $54,000 in stocks, but with the sharemarket usually fluctuating and resulting in highly uncertain outcomes in times of crisis, the best investment would be a Birkin Bag.

These bags are extremely exclusive when they release. The scarcity principle applies to them, but although waiting lists are 6 years for the bag, the profit percentage seen below not only accounts for those who bought a Birkin bag at retail price and sold it, but those who bought the bag at consignment or resale price as well and sold it.

Ultimately, although investing money into a bag may seem the opposite of innocuous, the facts and the research clearly depict that investing in a Hermes Birkin bag is the safest and most reliable investment in our world today. I personally also believe that it would be a great investment opportunity that would guarantee anything upwards of a 2.1% return for investors. All in all, the Birkin bag is a living example of how fashion, can significantly impact the economy, and can be an amazing investment for those smart enough to invest in it.

References

- https://www.businessinsider.com.au/stock-market-news-today-index-reaction-coronavirus-trump-fed-stimulus-2020-3?r=US&IR=T

- https://markets.businessinsider.com/news/stocks/new-york-stock-exchange-stock-market-trading-floor-closure-coronavirus-2020-3-1028990790

- https://www.investopedia.com/articles/investing/041415/investing-crisis-high-riskhigh-reward-strategy.asp

- https://www.ratecity.com.au/10-top-investments-young-australians

- https://time.com/4182246/hermes-birkin-bag-investment-gold/

- https://www.thefashionlaw.com/hermes-birkins-still-make-excellent-investment-according-us-investment-bank/

Ngl, really interesting topic. Really concise and the formatting was great. A great read ak!

LikeLike

What a super interesting way to think about diversifying your investments!

LikeLike

Very interesting. Interesting to see that the growth of the value of handbags is steadily increasing. But it is hard to believe that people will think that handbags are a stable investment unless they are already into the market.

LikeLike

very interesting topic!! 😜😊

LikeLike

Interesting way to invest! Wish I could afford one.

LikeLike

Never would’ve expected it!

LikeLike